To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Executive Director of Emirates Nuclear Energy Corporation (ENEC) Mohamed Al Hamadi says that this will happen no later than the end of 2020.

The first nuclear power plant on the peninsula should cover a quarter of the country's total electricity demand.

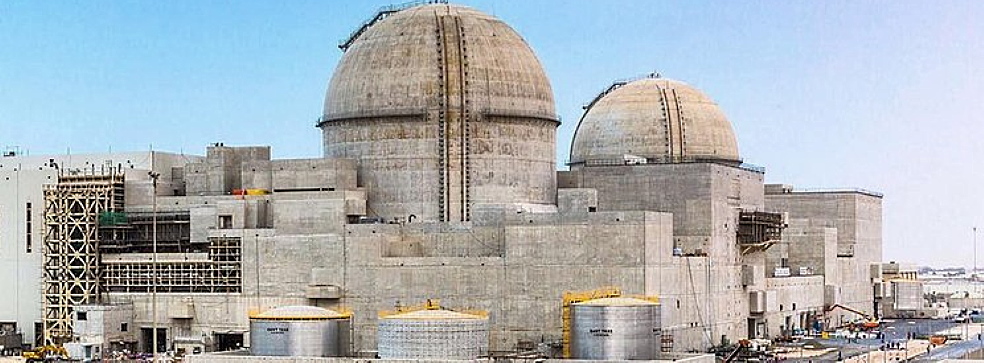

The construction of the first of four Korean reactors, the APR-1400, began in 2012 near Abu Dhabi, and the construction of three other power units began in the next three years. This happened in 2013, 2014 and 2015, respectively.

The first power unit was completed in 2018. In February 2020, the Federal Authority for Nuclear Regulation issued a license to operate the power plant for Nawah, a subsidiary of ENEC.

Only at the beginning of 2020, after 12 years of negotiations, the United Arab Emirates (UAE) received the green light at the international level for the operation of the first nuclear power plant.

This is an important achievement that will ensure the entry of the UAE into a club of 30 privileged countries operating nuclear facilities. The UAE is also becoming the first country to join the "nuclear club" in the last thirty years, since China did this back in 1990.

Authorities say that energy produced by a nuclear power plant will cover 25% of the country's energy needs. This investment project is funded from the UAE and South Korea. The main partner of ENEC is the Korea Electric Power Corporation (KEPC). The project cost exceeds $ 24 billion.

International experts note the UAE's responsible approach to the construction of a nuclear power plant.

To guarantee nuclear safety and reassure neighbors, the country's leadership signed the required international conventions and entered into an agreement with the United States, agreeing to never begin the process of enriching uranium or processing plutonium.

However, concerns remain about safety, as well as protecting the environment and the workforce. Although the APR-1400 reactors do not work with materials that can be used to create a nuclear bomb, many have expressed concern about a possible terrorist attack on a nuclear facility.

Obviously, the political situation surrounding the first nuclear power plant in the Arab world requires engineers to develop highly effective security systems.

Meanwhile, the Saudis said they were planning to build several more nuclear power plants for energy purposes, but so far they had not begun construction and had not signed any contracts.

The question remains, why does a country with a reserve of oil and natural gas for many decades strive to develop nuclear energy. UAE officials say they want to export more oil and natural gas.

However, the Saudis do not shed light on why the country is focusing on nuclear energy instead of solar photovoltaic power plants. The United Arab Emirates has unlimited desert territories and solar resources, and prices for solar electricity are declining, unlike nuclear energy.

Some analysts partially explain this by the desire of the UAE to obtain the status of a nuclear club country, as well as by the desire to encourage the training of local specialists in the field of nuclear energy and high technology.

Energy development in the UAE: prospects for investors

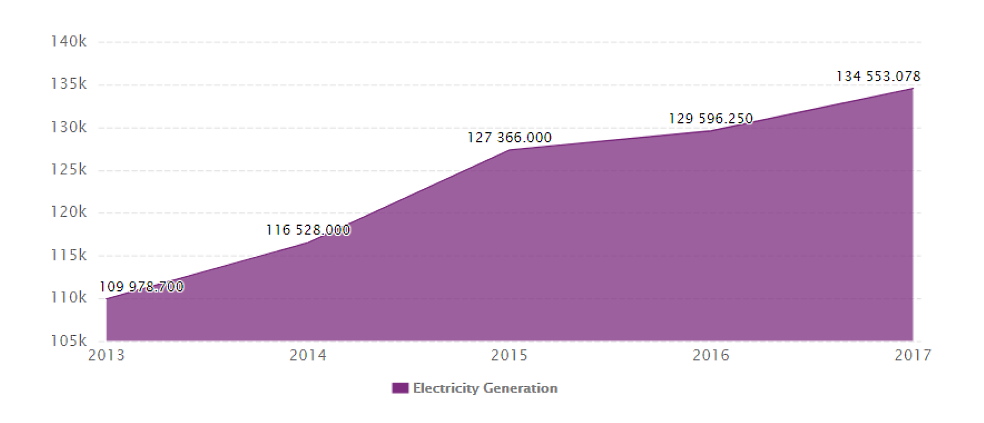

Businesses and citizens in the United Arab Emirates enjoy low, state-subsidized energy prices.However, this leads to excessive consumption: 2 or 3 times higher than the average in the rest of the world. For this reason, since 2014, the government has been thinking about raising prices, which will lead to a more responsible attitude to energy consumption and environmental protection.

UAE citizens can hardly be called modest. Because of cheap natural resources, they don’t think about the costs and prefer to buy cars with high fuel consumption. One of the biggest shopping centers (Mall of Emirates in Dubai) is equipped with a ski slope that maintains a constant temperature of -1 C at any time of the year.

Low energy costs attract energy-intensive industries such as aluminum processing. However, these plants are the main environmental pollutants on the peninsula.

In recent years, the government has struggled to reduce electricity consumption while trying to replace fossil fuel energy with renewable energy sources such as solar photovoltaic power plants.

In 2005, the United Arab Emirates, one of the first oil producing countries, ratified the Kyoto Protocol to the United Nations Climate Change Convention.

Abu Dhabi has established one of the most comprehensive clean energy initiatives in the world.

In the 2000s, Abu Dhabi allocated $ 15 billion for renewable energy programs. The Masdar Initiative emphasizes commitment to the global environment and diversification of the UAE economy.

The Initiative's partners include the world's largest energy companies and institutions: BP, Shell, Occidental Petroleum, Total, General Electric, Mitsubishi, Mitsui, Rolls Royce, Imperial College London, MIT and WWF.

Clearly, the United Arab Emirates is launching a new energy strategy to replace natural gas and oil with more sustainable alternatives.

According to initial estimates, replacing half of the energy currently used by the Emirates with renewable energy will lead to savings over the next 30 years, which will cover all the investments needed for this modernization.

According to rough estimates, the amount of investment for the transition to energy from renewable sources can range from 130 to 160 billion dollars over the next 30 years. This will allow the country to save about $ 200 billion over the same period.

Solar energy in the United Arab Emirates

The UAE’s ambitious energy plans will provide significant annual energy savings, increase hydrocarbon exports and help preserve the environment. Today, the country is almost entirely dependent on state-subsidized natural gas.The goals set for the UAE are rather ambitious, but no less ambitious are the new strategies of a number of other countries of the world that replace fossil fuels with renewable ones. For example, the UK plans to completely replace coal energy with renewable energy by 2025.

China has managed to reduce the consumption of fossil fuels and at the same time increase energy consumption through the development of green technologies. Today, China is the world leader in solar energy production.

It was the widespread use of solar panels in China that led to a sharp decline in the cost of equipment for the production of solar energy. This trend will completely change the global energy industry in the next few years.

Solar energy is getting cheaper, and in the next few years it will become the most affordable source of energy, especially in the favorable conditions of the Arabian Peninsula.

Amid falling oil prices, the United Arab Emirates seeks to make its economy independent of hydrocarbon exports. Almost every week, the government raises the question of finding and developing oil alternatives.

Doubling the production of solar energy in Dubai can prove the stability of the UAE economy.

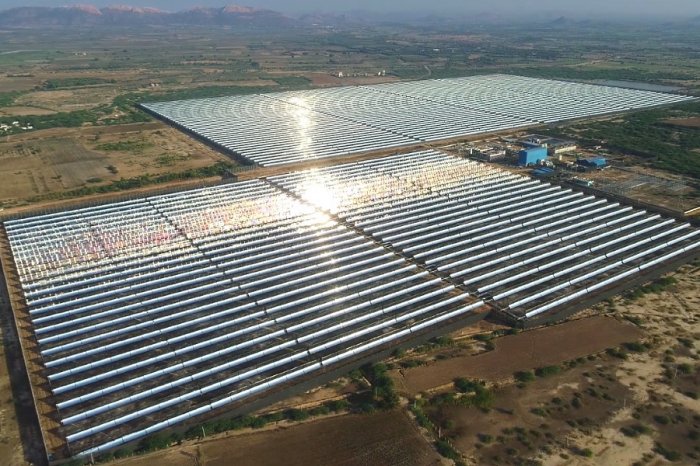

At the end of March 2015, a unique investment project was launched to build the largest solar power station in the region.

The solar energy complex under construction should reach a capacity of 5 gigawatts by 2030, becoming the most powerful object of this type in the world. In 2018-2020, three projects were already commissioned with a capacity of 200 to 300 megawatts, which provide electricity to hundreds of thousands of buildings.

The UAE hopes that the success of the first such large project should attract investors.

These are attractive investment opportunities for companies from all over the world.

At the same time, local authorities emphasize that an increase in oil prices at some point is inevitable. The government plans to increase renewable energy in order to gain an advantage in the global oil and gas market.

In November 2015, the prince of Dubai, Sheikh Mohammed bin Rashid Al-Maktoum, announced the launch of a strategy that will provide up to 75% of electricity production from alternative clean sources by 2050.