To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

The United States, Australia, Qatar and other countries are ramping up their investments in the LNG industry, and leading energy companies such as Shell, Total, Petronas and ConocoPhillips are funding new LNG plant projects.

Project financing of LNG plants is currently taking on new forms, supported by new investment instruments and financial models.

We have brought together a team of experienced professionals ready to meet any of your needs in long-term financing of oil and gas projects.

Skywalk Investment Group offers the following services for LNG plant projects:

• Long-term investment loans.

• Project finance (PF) scheme.

• Credit guarantees.

• Investment engineering.

• Investment consulting.

• Financial modeling.

• Project management.

• EPC contracting, etc.

Our company is actively developing all over the world, including Spain, Germany, USA, Mexico, Brazil, Saudi Arabia and other countries. Contact SWIG representative to learn more about our offers for oil and gas companies.

Project finance concept for the construction of LNG plants

Financing large investment projects in the field of liquefied natural gas, such as the construction of LNG plants and regasification terminals, requires the joint efforts of many banks, companies, as well as the state, which seeks to form a favorable basis for the development of this strategic sector.

Significant funds from various sources are needed to achieve long-term growth.

Financing of LNG plants can be carried out under a project finance scheme, which involves the establishment of a special purpose vehicle (SPV) and the allocation of borrowed funds against the future cash flows of the project.

Project finance can be a good alternative to traditional corporate finance tools, given the high capital requirements and other features of facilities associated with the production and distribution of liquefied natural gas.

There is no doubt that this scheme requires clear rules and a transparent legal framework that guarantees a rational distribution of risks and responsibilities of project participants.

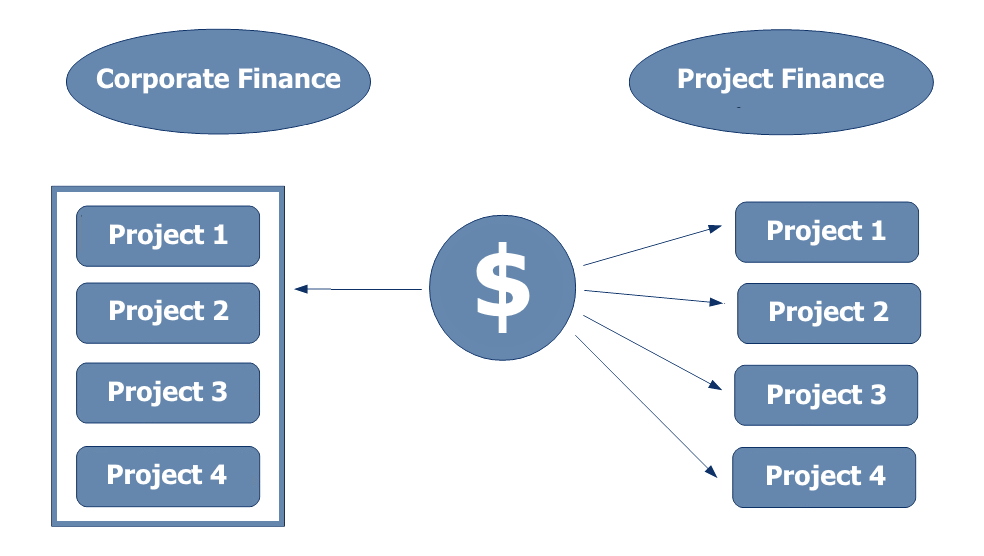

Project finance vs corporate finance

The traditional approach to corporate finance is characterized by the fact that lenders allocate funds to the company, and not to its specific project.If the borrower is an oil and gas company, it can get a large loan to use it for various purposes, including the purchase of LNG tankers, expansion of regasification terminals, etc. On the contrary, project finance applies to the financing of a specific project, which must be appropriately isolated from the rest of the business activities.

In the case of traditional financing, all of the company's assets can be used to repay the debt, while in the case of PF schemes, only specific project assets serve as collateral.

This is the so-called off-balance sheet financing.

As for traditional financing, its cost depends on the reputation of the company, its risks, past activities, credit history and guarantees provided. The cost of the PF is based on the potential performance of the project, the expected cash flows, and the risks associated with the project.

Project finance is used to finance large-scale projects (infrastructure, LNG, energy projects) that require a very long financing period.

On the other hand, in corporate finance, borrowed funds can be used to replenish working capital, service other loans, purchase equipment, and for other purposes with different time horizons (short-term, medium-term, long-term).

Figure: Key difference between PF and traditional corporate finance.

Advantages and disadvantages of project finance for LNG plants

One of the undoubted advantages of project finance is considered to be high financial leverage, which allows project participants to attract significantly more resources than they could receive through traditional mechanisms.Off-balance sheet financing allows companies to develop several large LNG projects, the cost of which is many times higher than the value of the initiator's assets.

The contractual structure of the PF is aimed at diversifying risks between contractors, initiators and other parties. Risk minimization is also achieved through insurance. Another advantage of the PF in relation to project risks is the isolation of project risks from participating companies. This is especially important in LNG producing countries with high economic and geopolitical instability, which increases the risks for these projects. In such countries, the use of project finance schemes can be beneficial as it will provide greater predictability for companies in the sector.

The introduction of this scheme allows governments to implement projects for the construction of LNG plants around the world, especially in developing countries.

For local companies, this is also a unique opportunity to work together with the leaders of the global oil and gas industry.

As for the disadvantages, we can mention the complexity of structuring and organizing project finance schemes, which is associated with a huge number of contracts and stakeholders. Prior to the start of the project, it is important to negotiate and agree on the terms of cooperation, including numerous legal and financial aspects.

A complex structure is also considered difficult to change.

Any change in the terms of project finance requires a lengthy review of contracts and entails significant additional costs.

Since LNG plant projects operate in an environment of volatile natural gas prices, participants put their businesses at risk if initial conditions are not met.

A serious obstacle to the use of project finance instruments in some regions is the poorly developed capital market, which is not able to support this type of financing in a sufficiently flexible and dynamic way. Since the list of leading LNG exporters includes such countries as Nigeria, Algeria and Indonesia, this factor must be taken into account when choosing financing mechanisms (issuance of project bonds in the local market may have limited success).

When it comes to SPV bonds, these securities should be placed on foreign markets to attract investment on adequate terms.

On the other hand, it may be inconvenient given macroeconomic, geopolitical issues, recession due to Covid-19 and other factors. In any case, the choice of LNG plant financing options and specific financial instruments should be entrusted to an experienced financial team with international experience.

Risk management in financing LNG plants

Risk management activities during the construction of liquefied natural gas plants will require a comprehensive professional approach, given the technical complexity, environmental hazards and high cost of facilities of this type.Risk management in project finance should include:

• Identification, qualitative and quantitative assessment of risks.

• Development and approval of preventive measures and alternative action plans.

• Allocation of financial resources to offset the consequences of negative events.

• Monitoring, control and implementation of the above measures.

Below we have listed some risk categories specific to LNG plant projects / oil and gas projects.

Financial risk refers to changes in interest rates and unpredictable fluctuations in exchange rates, which can lead to significant losses for project participants. This risk is extremely important to take into account in international projects for the construction of LNG plants, because exchange rate changes may affect the payment of loans in foreign currency, the cost of foreign equipment and other aspects of the project.

Credit risk refers to the possibility that a debt will not be repaid or a payment schedule will be violated. This risk is related to the correct development of the LNG project and is determined by many uncontrollable factors (default, embargo, war, etc.).

Political risk is associated with the instability of state institutions. This implies an unforeseen change by the government in the terms of the concession contract or the license revocation.. Since the operation of LNG plants directly depends on access to natural resources and requires licensing, the state plays an important role role in the development of such projects. The government, as a contracting party, is responsible for taking responsibility for risk management, as well as for ensuring the safety of the project at all its stages.

Legal risk depends, on the one hand, on well-thought-out contracts, and on the other hand, on the mature legislative framework of the host country. Thus, a strong state with a stable legal and fiscal policy is a determining factor for the success of LNG projects.

Environmental risk may result in a project being changed / stopped for environmental reasons. It is very important at the planning stage to resolve all issues that relate to environmental legislation and meet the requirements of the local community regarding environmental protection.

Commercial / market risk refers to the demand and prices for liquefied natural gas, which may not meet the expectations of the project participants in the long term. If forecasts do not come true, this may jeopardize the repayment of loans and cause further destruction of the financial foundation of the project according to the "domino principle".

Construction / operation risks. This category includes any risks associated with the activities of contractors, subcontractors and companies operating an LNG plant, mainly related to cost overruns or delays. Sponsors' guarantees upon completion of the project are usually included in the contracts.

If you are looking for professional investment engineering, investment advisory, project management and financial modeling services, please contact SWIG for details.

Our company also offers long-term financing for LNG projects for up to 20 years.

Experienced professionals ensure the reliability of our solutions in the oil and gas industry.