To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Professional risk management in large projects increases the chance that the project will be properly planned and implemented in accordance with the original intent of the participants.

Risk management services include measures such as identifying potential threats, predicting their impact, developing and implementing risk mitigation plans, and ensuring that investment objectives are met.

The rich experience of professionals multiplied by innovative technical solutions opens up new opportunities for companies, allowing them to implement projects more safely and efficiently.

Skywalk Investment Group, a company with international financial experience, is ready to offer your business a full range of services in the field of financing large investment projects, financial modeling, project management, investment engineering and consulting.

Contact our representatives to find out more.

Fundamentals of investment risk management

Any business project is characterized by uncertainty.Even with clear plans, a company can never be fully prepared for everything that can happen during a project.

It is necessary to constantly take into account the various risk factors that may arise during the implementation of investments in order to prevent any adverse events.

If the project is not properly protected from threats, the risk of negative events will increase, and the consequences will be more serious than expected. Therefore, the project manager and management team may find themselves in a situation in which they will be forced to react to the negative consequences of events instead of preventing them.

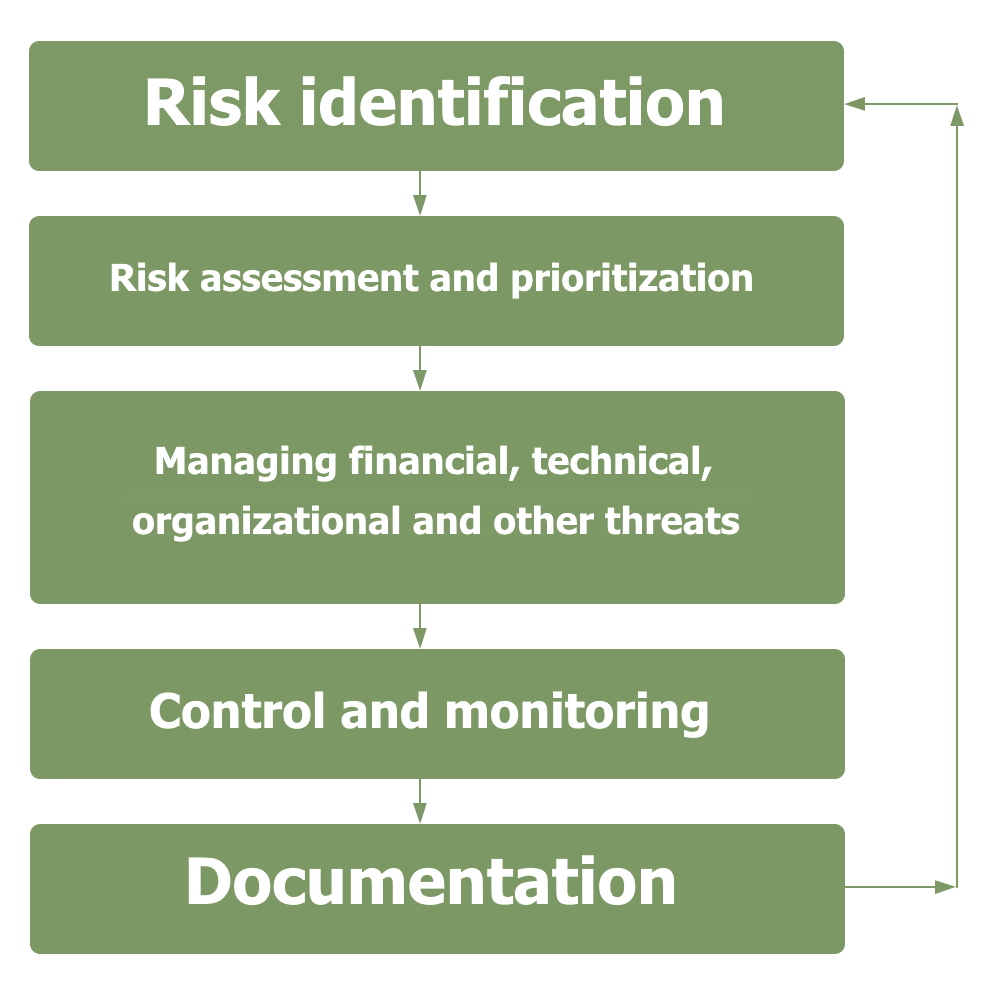

Investment project risk management is a cyclical process that is repeated many times during the project implementation. When planning a project, it is important for participants to immediately identify the main types of risks, develop alternative plans and provide resources for contingencies.

During the project implementation, these activities are periodically repeated.

This is critical in order to reassess the possibility of certain threats, detect new ones, and also put into action previously prepared plans aimed at preventing the negative events or minimizing their consequences.

The concept of risk analysis in an investment project is not new. It includes systemic activities to create a project and evaluate deviations that may occur during its implementation.

A professional project management team is able to use these tools wisely and prepare the project for possible negative events. Risk management in large investment projects gives more room for maneuver, allowing the business to choose a project option that minimizes potential losses and creates the greatest chance of achieving initial results.

Risk management is deeply integrated into the project management process and into the company's development strategy.

This activity is aimed at achieving the following goals:

1. Improving the information support of the project, including to clarify the objectives of the project in terms of time, costs and specifications.

2. Making more effective management decisions that allow project participants to better adapt to changing business conditions.

3. Increasing the chances of project success due to a better understanding of the threats that may arise, as well as due to the planning of preventive actions.

4. Informing the parties involved in the project about the existing threats to the project in order to coordinate actions.

According to the Project Management Body of Knowledge (PMBoK), risk management processes include planning, risk identification, qualitative analysis, quantitative analysis, risk response planning, and control. These cornerstone elements are summarized in the table below.

Table: Elements of project risk management according to PMBoK.

| Element | Brief description |

| Planning | Planning activities help project teams better understand how to perform risk management activities within a project. |

| Risk identification | Risk identification shows which risks can affect the project, including detailed documentation of their main parameters and impact on the project. |

| Qualitative analysis | Conducting a qualitative risk analysis prioritizes risks, makes it possible to further analyze them, assess the likelihood and consequences of their occurrence |

| Quantitative analysis | Quantitative risk analysis involves the numerical analysis of the impact of identifiable risks on project goals. |

| Risk response planning | Risk response planning involves developing solutions and actions to increase opportunities and reduce threats to project objectives. |

| Risk control | Risk control includes the implementation of risk response plans, tracking changes in risks, monitoring residual risks, identifying new risks, and evaluating the effectiveness of management activities. |

The Project Management Guidelines of the International Project Management Association (IPMA) place a lot of emphasis on risk management as one of the most important elements of project management.

In addition to the elements mentioned, IPMA focuses on project margins, residual risk, strategies and plans to respond to threats and opportunities, SWOT analysis, scenario planning, sensitivity analysis, etc.

Of interest are the so-called Agile Project Management Methods (APM), focused on creating innovative solutions.

The idea of APM is to iteratively present the products of an investment project. Thus, risk management in a large project is usually a continuous iterative process leading to the identification, analysis and, ultimately, assessment and prioritization of threats.

Figure: Risk management process in a large investment project.

Risk management standards for large projects

The risk significantly affects the achievement of the set goals and the expected effectiveness of investment projects.The level of risk depends on the complexity of the project, the experience and size of the company, resources, etc. This is a combination of internal and external factors that positively or negatively affect the final result of the project.

However, international organizations and expert groups offer different standards for risk management in investment projects.

We have analyzed some of them in the table below.

| Standard | General approach | Risk management process |

| ISO: International Standard Organization |

|

|

| PRINCE 2: Projects In Controlled Environments |

|

|

| COSO II: Committee of Sponsoring Organizations of the Treadway Commission |

|

|

| PMI: Project Management Institute |

|

|

| FERMA: Federation of European Risk Management Associations |

|

|

| COBIT: Control Objectives for Information and related Technology |

|

|

As we can see, investment practice has created numerous risk management standards, each with unique features, benefits, and limitations.

The decision to use one approach or another should be made by the participants based on their specific project.

Project risk management methods

The most important issue in the analysis of an investment project under conditions of uncertainty is the choice of a method and tools for managing risk.Investment experts offer such project risk management methods as elimination, prevention, insurance, risk absorption and others.

Elimination of risk means, in essence, the rejection of an investment project or its significant transformation, after which the project risk is reduced to a minimum. Since the elimination of project risks is carried out on the basis of their in-depth analysis, experts use various information technologies and innovative techniques for quantitative analysis and qualitative risk assessment.

Control and prevention actually means organizing project activities in such a way that project participants can influence risk factors to the greatest extent and reduce the likelihood of negative events.

This may include activities such as training for personnel, purchase of special equipment, improved process control, reorganization of the most vulnerable processes, additional quality control, etc. In other words, this activity covers almost all aspects of the investment project.

Risk absorption means a special way of conducting project activities, in which the responsibility for losses in the event of a negative event lies entirely with the project participants. This method of project risk management is mainly used when the risk is small or the damage in the event of a negative event does not have a significant impact on project participants.

Risk insurance is a method that allows project participants to reduce losses arising during the implementation of an investment project by compensating for losses from special insurance funds.

One of the most important types of insurance in the implementation of foreign investment projects is insurance of investments against political risks. This may include changes in legislation that adversely affect foreign exchange transactions, taxation, reinvestment of income and free use of assets within the framework of an investment project.

In addition, risk insurance allows companies to secure their assets in regions that are prone to wars and revolutions.

Among the most well-known international organizations that insure export credits and international investments against political risks are Overseas Private Investment Corporation (OPIC), Export-Import Bank of the US, Export Credits Guarantee Department (ECGD), Compagnie Francaise d'Assurance pour le Commerce Exterieur (CO FACE) and other organizations.

Political risk insurance is also carried out by some private organizations, including jointly with government agencies.

Among the largest private insurers we can mention American International Group.

Are you looking for long-term financing of a large investment project or professional investment services?

Contact an SWIG representative and schedule a consultation.