To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Improving the efficiency of investments is mainly aimed at optimizing project structure, minimizing risks, control and decision-making.

Large projects characterized by high complexity and innovative activity are associated with financial, engineering, organizational, financial and reputational risks. One of the important ways to reduce project risk is to use appropriate assessment methods at all stages and in all areas of project development, i.e. use of an integrated project evaluation system.

Since there is currently no unified system, project teams widely use separate, most convenient concepts and methods for project evaluation and investment management.

Projects are implemented by various entities, not necessarily operating in the commercial field, and financial efficiency is not the only criterion for evaluating the effectiveness of project. For example, the specifics of projects implemented by local governments (municipalities) are difficult to measure by generally accepted business parameters.

However, the financial performance provides a solid foundation that is needed to expand investment financing opportunities.

The adopted strategies for managing the financial efficiency of investment projects require professional economic calculation.

An important role in these calculations belongs to discounting methods, which continue to evolve towards various modifications.

Systems of management, control and planning within the framework of the systems approach are used to support decision-making processes related to setting and changing the course of the project, assessing deviations from the approved plan and optimizing activities.

Monitoring systems inform project participants about emerging opportunities or threats arising from a possible favorable or unfavorable change in internal and external factors for the development of the project. This helps to make the investment project more flexible and viable.

The most popular methods for choosing investment decisions are the net present value (NPV) method and the internal rate of return (IRR) method, which is confirmed by international experience in the field of investment.

Research on applied capital budgeting techniques shows that 75% of CFOs always or almost always use the NPV method, and 76% of CFOs always or almost always use the internal rate of return.

Experts note serious shortcomings of the internal rate of return, especially for complex and non-standard projects. While net present value plays an important role, potential investors are also interested in other issues, including the size of the project, the average annual rate of return on invested capital, and the discounted payback period. It is not enough to continue to use the classical evaluation of investment projects based on NPV and IRR in many cases.

Classification of project performance management strategies

The expansion of the range of tasks can be described using a four-field matrix of the strategy for managing the financial performance of investment projects.The strategies within this matrix can be classified according to the mode of operation (rigid or flexible) and the openness of the system (isolation or cooperation). This approach allows us to distinguish four strategies listed below.

Figure: Project performance management strategies matrix.

| Cooperation | Synergy strategy: project management in close relationship with other investments, but still without sufficient flexibility. | Integration strategy: close interaction with other investments with high project flexibility. |

| Isolation | Isolation strategy: managing an investment project in isolation, with a low level of flexibility. | Flexibility strategy: isolation from other investment projects, but with a high level of flexibility. |

| Rigidity | Flexibility |

The issues of interaction between components and the flexibility of investment projects can be considered separately, but when managing complex systems, they usually arise simultaneously.

Due to the many costs associated with achieving possible side effects, it is recommended that the net present value be used as the basis for project evaluation.

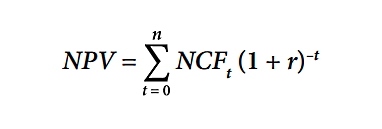

Due to the absence or complexity of calculating the internal rate of return, which is typical for some types of investment projects, the formulas for assessing the financial effectiveness of projects are sometimes based on net present value indicators. NPV refers to the discounted net cash flow given the investor's expected return. Depending on the adopted strategy, NPV can be expanded due to the synergistic effect of several investment projects.

Table: Performance management strategies and net present value of investment projects.

| Integrated investment projects | NPVpz = NPVp + Ep | Integration strategy | |

| NPVp = NPV1 + NPV2 + Es | Synergy strategy | ||

| Independent investment projects | NPV1 | NPV2 | Isolation strategy |

| NPV1R = NPV1 + E1 | NPV2R = NPV2 + E2 | Flexibility strategy | |

Es – synergy effect;

NPV1,2 – net present value of the particular project;

Z – integrated version with synergy and real options;

R – extended version with real options.

In a market economy, attracting capital to investment projects is driven by the desire to maximize its value in the time horizon adopted by the investor, while ensuring business continuity.

In modern strategies for managing the financial performance of investment projects, there is a tendency to increase the role of synergistic effects and a comprehensive risk assessment. Achieving the expected level of return on invested capital remains a serious problem that finance teams face when planning and modifying the strategy for the development of large businesses.

Project isolation strategy

The so-called isolation strategy is considered in two dimensions, including the following:1. Isolation from the environment and other investment projects.

2. Refusal of changes after the start of the selected scenario.

Violation of any of the above conditions leads to additional effects, the inclusion of which may change the decision to accept / reject the investment project. In this way, isolation can be viewed as a simplified model for evaluating and managing project performance.

Traditional project evaluation tools are sufficient when the projects are independent and there are no expected changes in the cash flow statements that may occur in the future. This requires reliable estimates and the absence of alternative opportunities during project implementation.

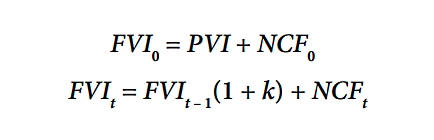

A comprehensive analysis of the phases of creating and dividing the future invested value (FVI) can also be carried out. At the project creation stage, FVIn depends on the amount of invested capital (PVI) at the start of the project (t = 0), and the reinvestment rate (k), which indicates the level of profitability from current investments of financial surpluses (temporarily free cash flow) and net cash flow (NPF0; NPF1; NPF2, NPFn) for the n-year forecast period.

The future value of invested capital refers to the level of free cash available for reinvestment at the time the project is closed (t = n).

The level of capital for reinvestment in subsequent years (t = 0; 1; 2; n) can be determined by the following formula:

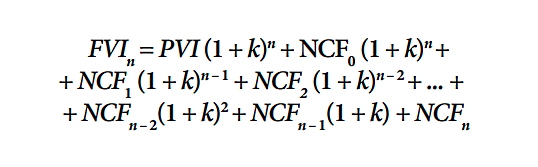

In a more expanded form, this formula can be represented as follows:

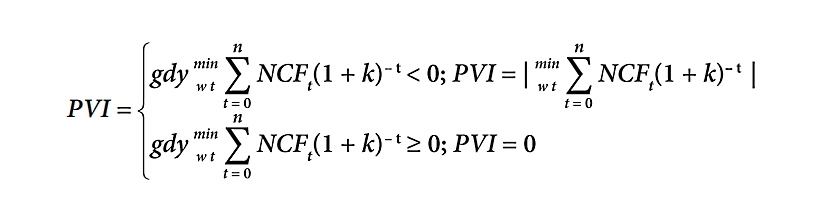

As part of this approach to evaluating the performance of investment projects, it is also possible to calculate the minimum level of invested capital that provides sufficient liquidity throughout the life of the project.

This is a much more complex formula, which might look like this:

At the stage of calculating the cost of future invested capital, the significance of the expected rate of return (r) increases in terms of the threshold point, which is used to assess whether a particular project meets the minimum financial requirements of the investor.

The expected rate of return is taken as the lowest that the investor is willing to accept. It is important to understand that this is the minimum acceptable rate, not the desired rate.

Let's take a look at the following calculations:

1. Investment project planning phase: FVIn.

2. Phase of project separation: PVI (1 + r)n + PVI ((1 + b)n – (1 + r)n).

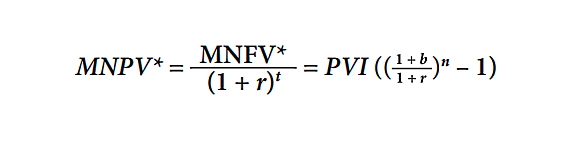

Here b is the average annual rate of return on invested capital; PVI ((1 + b)n - (1 + r)n) is the excess of the future value of the capital over the investor's expectations (MNFV). The result obtained using the discount rate r can be reduced to the present value (Modified Net Present Value, MNPV).

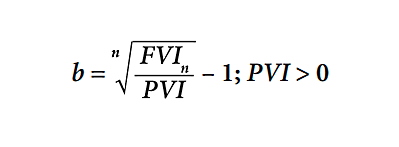

The average annual rate of return on invested capital (b) can be calculated as follows:

MNPV * in the forecast period of n years remains in the correlation with PVI, b and r:

The financial performance of the project must comply with MNPV ≥ 0 or b ≥ r.

The fulfillment of this condition means that the excess of the future value over the investor's expectations will not be negative.

When choosing one of the mutually exclusive investment projects based on PVI, one should take into account the scale of the project and the life of the project at the same rate.

When r = k, the formula takes the form of the NPV method, becoming a special case of the MNPV:

The NPV method is closely related to IRR (rate of return for which NPV = 0) and discounted return period (the point in time when NPV = 0).

For a typical investment project (when r = k), a comprehensive map of the project's financial efficiency can be drawn up, including a multi-aspect evaluation. This evaluation takes into account indicators such as net present value, internal rate of return or payback period, average annual rate of return, as well as discounted payback period.

There is also a broad group of more complex projects that have at least one cash outflow after one or more cash inflows. For these projects, it is recommended to evaluate financial efficiency in terms of MNPV and average annual rate of return (b).

Project flexibility strategy

In the case of multi-stage investment projects, depending on their flexibility, it is possible to use options for modifying the scenario at control points after the end of each stage.In relation to the management of investment projects, there are two main types of project flexibility:

1. Internal flexibility associated with a particular project and resulting from changes during the implementation of the project, as a response to changes in the external environment or additional information about investment opportunities.

2. External flexibility that comes from the fact that the implementation of a particular project allows sponsors to launch other projects and use the potential benefits arising from the complementarity of several investment projects.

As a result of the accumulation of professional experience in the subsequent stages of the project, obtaining additional information about the market and expanding the possibilities for modifying the development strategy, there is a chance to increase the benefits of the entire project. This requires the project to move away from strict scenarios for managing the financial performance of the project in the direction of its modification and adaptation to new realities.

The emergence of new opportunities and threats in the future justifies the use of scenario planning, that is, the creative combination of accurate information and uncertain assumptions.

This allows project participants to better prepare for future challenges and improve investment performance across the full range of possible conditions.

Regarding the modification of the company's strategy, some researchers use the term real options (option means the right, not the obligation to take certain actions in the future). Risk is seen as an opportunity, not a threat. It should be noted that real options accompanying ongoing projects are not always noticed by the company's management.

The main real options include:

• Delay option, which means delays in project launch schedule.

• Opt-out option, which means that the participants can refuse to continue the project.

• The option to change effective solutions in terms of technologies, markets, products etc.

• The option to scale the project, both in the direction of cost reduction and increase.

• Development option that can make a project that initially causes losses very profitable.

The most difficult are complex options, in which the implementation of each previous phase opens up new options in the following stages.

If each of them is correctly considered in the project development scenarios, project performance management turns into a complex and time-consuming activity that requires the involvement of a large team.

The use of option rights brings additional value to the project, but the project can have both purchase options and put options. The latter, when used in adverse circumstances, lead to a decrease in the value of the project. Therefore, the net present value (excluding options) must be increased by the value of purchase options and reduced by the value of put options.

A relatively simpler tool for valuing tangible options could be the so-called binomial model (instead of adapting the standard financial option model to valuing tangible options). However, their evaluation is very complex and therefore can lead to errors and wrong decisions.

Caution is advised when evaluating real options, although potential benefits of revision could be significant.

Project synergy strategy

At the stage of creating the future value of invested capital, reinvestment is used, which is considered a way to manage temporarily free cash.The approved financial configuration, i.e. the funds in the base area of the project and the funds in the area of reinvestment, together constitute the financial backbone of the commercial project.

The isolation strategy ignores the interdependence of the project with the environment and other components of the broader strategy, assuming a single rigid scenario.

In addition to the financial efficiency of the investment project, it is important to take into account a number of other parameters. They can be used by the project team to evaluate the investment more broadly, for example, taking into account the social or environmental benefits of the project.

The inclusion of an investment project in the current activities of the company requires the identification of all possible synergies resulting from the feedback between the project, the market environment and current activities. When forming investment portfolios, financial teams should keep in mind the need to integrate individual projects into a single system solution, the performance of which will differ from the total performance of all these projects.

When planning a portfolio consisting of a set of available investments, mutually exclusive (alternative) projects, independent projects and interdependent projects are distinguished.

In the case of interdependent projects, it is important to take into account the positive or negative synergy effect, which is demonstrated by comparing the system solution with the basic performance of the separately considered projects.

When planning an investment portfolio, three main analyzes are carried out:

• Analysis of strategic prerequisites and assessment of the compliance of projects with the company's investment strategy.

• Evaluation of individual project proposals without taking into account the links and interactions between investment projects.

• Comparison and selection of optimal projects for an investment portfolio based on the profitability of individual projects and their interactions.

The main forms of project integration at the financial level and integration at the operational level.

A potential way to generate synergies is to offset the positive and negative net cash flow vectors of individual projects and modify the portfolio net cash flow vector by adjusting key variables such as sales, costs and expenses. Sources of synergy can be found in the areas of revenue synergy, cost synergy, tax synergy, and financial synergy.

Combining complementary projects results in better, adjusted values for both portfolio financing capital and net present value, as well as indicators of financial performance calculated using these values. Thus, the financial performance of a properly prepared investment portfolio can be significantly better than the sum of the performance indicators of all projects separately.

Project integration strategy

Elements of synergy and flexibility coexist in the project integration strategy, which leads to additional effects from both approaches.This also applies to large portfolios of investment projects.

At the stage of developing a development strategy, the project team should take care of achieving positive synergies, take preventive actions against possible negative effects, and evaluate the total synergistic effect (preferably in several scenarios). Either way, flexibility remains a desirable feature of business planning.

Depending on emerging opportunities and threats, the previously adopted strategy can be modified, including reconfiguring the investment portfolio.

The process of managing a portfolio of investment projects cannot be the sum of actions aimed at each project separately. Project portfolio management must take into account the complexity of the issues involved in planning, organizing, coordinating and controlling many projects at the same time. Staying flexible is the answer to the challenge of preparing a business for future challenges in a highly competitive and volatile environment.

Due to the high importance of the activities associated with modifying the existing action plan and determining the ways of the project development in the long term, it is critical to collect and analyze all available information about the project and its environment.

This will allow the project team to detect indirect signals of new threats in time and take the necessary measures to improve the financial performance of the investment project.

Any set of scenarios adopted to develop a flexible strategy should be reviewed and updated regularly.

The variety of possible forms of cooperation, as well as the multiplicity of goals set by managers, make it necessary to carefully observe the effects of synergy. Examples of partial synergy include new properties, range effect, domino effect, butterfly effect, threshold effect, and others.

How to improve the performance of an investment project

The highly competitive conditions of investment activity require companies to develop new approaches and techniques for managing the performance of investment projects.The range of these tools is not limited to the four strategies described above. Nevertheless, these strategies can be successfully used in investment practice, at the stages of choosing investment alternatives, planning and implementing large projects.

At the same time, the assessment of the financial performance of projects using the proposed methods can serve as a guideline when comparing the synergy strategy, the flexibility strategy, and the strategy integrated with the isolation strategy.

By integrating projects, companies expect to capture positive synergies and eliminate negative effects, and also want to take advantage of expected and upcoming opportunities to improve project performance.

These additional effects can serve as a basis for a decision to finance a project even if the result of the traditional evaluation is negative, especially when this result is close to the cut-off point. The increase in management efficiency is supported by integrated strategies that achieve the effects of presenting multiple projects and the effects resulting from the correct integration of the enterprise into the environment, as well as the effects of modifying previous development scenarios.

Supplementing traditional discount methods for evaluating investment projects with additional elements can help improve the correctness of investment decisions.

Keeping track of opportunities and threats often makes companies realize that the original plans quickly become obsolete and that the business needs to take periodic corrective action.

If you need professional financial modeling services or are looking for long-term financing for an investment project, contact Skywalk Investment Group.