To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Consequently, any project has some degree of risk and uncertainty.

When making a new investment decision, it is important to take into account that it may turn out to be partially or completely wrong and will not bring the expected financial results to the project participants.

The uncertainty that accompanies any business is a source of risk. In a free economy, investors cannot count on constant high prices, constant demand for products, full utilization of production capacities throughout the entire life of a project, or a stable rate of return on invested capital.

Skywalk Investment Group, an investment consulting company headquartered in Spain, is ready to offer a wide range of professional services in the areas of project financing, financial modeling and large project management.

We have specialized in energy, heavy industry, infrastructure, mining, real estate and tourism projects for over 20 years.

If you are interested in financial, technical or legal support for your business, please contact us for advice.

General concept and types of investment project risks

The concept of "investment risk" is closely related to the term "uncertainty", the essence of which financiers have been debating for over a century.Risk equates to the uncertainty that determines its level. This means that the higher the level of project uncertainty, the higher the risk, and vice versa.

Both of them are positively correlated with the life of the investment project.

In other words, the longer the planning and implementation period of the project, the higher the risk and uncertainty.

Unlike uncertainty, risk is a dynamic and measurable category that changes depending on the actions taken by the parties and the evolution of the surrounding business environment.

The peculiarity of a large investment project is the large scale and high complexity of the business environment. This leads to the complexity of project planning and risk management, requiring the involvement of specialized expert groups.

In the financial literature, the concept of investment risk is defined as the probability of failure to achieve the goal (in the case of an investment project, this means losses).

For this reason, risks are taken into account when making every investment decision.

However, the above definition represents a very narrow approach to risk. Although risk is usually associated with something negative (lack of success in achieving the results), sometimes we also deal with the risk of positive events when the project has exceeded the planned results.

Table: Some positive and negative changes in the investment project.

| Positive changes | Negative changes |

|

|

In the broadest sense, the concept of investment project risk is defined as the probability of events that positively and / or negatively affect the achievement of the goals set by the project participants.

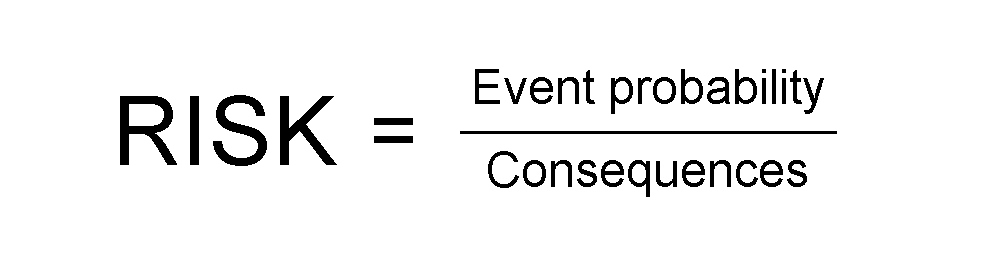

Perceiving risk in terms of likelihood and consequences is expressed in the equation:

Risk is considered to be an integral part of any investment decision making process.

For this reason, the investor should keep the following two principles in mind:

• High risk is accompanied by the expectation of higher returns.

• Increased risk means the possibility of incurring a higher loss.

In the case of a high-risk investment project, investors will demand a higher rate of return that compensates for the risk.

Otherwise, they will not make investments, which is quite predictable.

An important feature of investment risk is its dynamic nature:

• The level of risk is directly related to the duration of the investment project and is steadily increasing over time.

• Investment risk relates to the rate of return that affects cash flows and the change in the value of money over time.

• Any risk has a price that depends on the type of risk and how it is defined.

Risk management in a large investment project today is an independent complex area of activity that requires the participation of professionals.

If you need advice, please contact SWIG team.

External and internal risk factors

All factors responsible for the emergence of uncertainties and risks in the investment process can be divided into external and internal.External ones are beyond the control of investors, but they should be taken into account when financing large business projects and assessing their real effectiveness. Internal factors can be changed by the decisions of investors, and therefore they can be adapted to their expectations.

External risks are usually divided into three levels. Understanding the relationship between events at each level helps to improve the efficiency and safety of investments.

Table: Three levels of investment project risks.

| Level | Essence of risks |

| High level | Global events that affect the economic or political situation in the whole world and regions. These include armed conflicts, pandemics, major events in the stock markets, shortages of raw materials and global supply chain disruptions. These factors are becoming more and more significant, given the trend towards globalization of the economy. |

| Average level | Risk factors associated with the competition in the sector, the market strength of suppliers, the level of innovation, product changes under the influence of new market requirements. |

| Microlevel | Specific risk factors that directly affect the investment project and its environment. These factors are determined using various financial tools. |

European financiers offer a convenient classification of the risks of an investment project, depending on the nature of the factors affecting business activity:

• Market risk factors, among which the instability of the cost and demand for goods (services) and energy resources, the actions of competitors, etc. play an important role.

• Technical risk factors associated with equipment breakdowns, lack of qualified personnel and problems with the introduction of modern technologies.

• Political risk factors, including international tensions, sanctions, changes in domestic policy in the host country, and so on.

• Natural factors such as earthquakes, floods or pandemics.

When the above classification is used, it is expanded to include organizational, geographic and social factors, especially in the case of large energy or infrastructure projects.

The level of detail of the risks of an investment project, as a rule, depends on its budget.

When analyzing investment projects, our team also takes into account the second area of risk, the internal environment of each project or even its individual variant. In each case, the resulting internal risks can be unpredictable and significantly reduce the profitability of the entire project.

This is extremely important from a practical point of view, since many project risks are actually generated by the management of the company that leads the investment project. The human aspect in the context of identifying sources of risks cannot be ignored or limited, since the decisions of a top manager in many cases can be irreversible and have disastrous consequences for the project.

Other types of investment risks

In recent years, the division of investment risks into general and specific ones has been widely used.General (systemic) risk stems mainly from the macroeconomic conditions in which the project is being implemented. Many interesting approaches to assessing the business environment can be found in the financial literature. In general terms, they can be divided into factors of a closer competitive environment and factors of the macroenvironment.

A very popular classification of environmental factors is the PEST classification.

However, it is now being replaced by the PESTGEL classification, which complements the PEST method with environmental, globalization and legal factors.

Experts also suggest dividing risk into financial and operational. Financial risk is associated with the structure of the project's funding sources. It grows with an increase in the share of external funds in financing an investment project, which increases the risk of activity and makes it less attractive for banks and other financial institutions at the national and international level. On the other hand, this situation can lead to a positive effect of financial leverage, creating additional benefits for the owners.

The so-called operational risk relates to the ability to influence sales, costs and prices, the level of competition and threats posed by substitute products, management efficiency, the bargaining power of leadership and the level of diversification.

Risk management in the context of the investment cycle

Taking into account the above classification of sources and types of risk, understanding the sequence and interdependence of actions in the preparation of a large investment project and the sequence in its implementation is necessary to avoid / reduce the risk of misallocation of capital.The preparation and implementation of projects is always a complex process that includes various financial and engineering works, which creates a high potential for risk.

The main features of the new investment project include the following:

• The novelty of the project.

• The scale of the business activity.

• Profit and loss variability.

• Development of a unified strategy.

• Evolution of activity taking into account experience.

• Using knowledge to create a new business entity.

• Purpose (business, organizational, quality).

• The mission of the initiating company and the specific project.

• Other factors, depending on the business.

The variety of variables that characterize a new investment project creates enormous difficulties for initiators and forces them to look for the most appropriate tools for identifying and managing risks.

Risk identification is difficult for most companies, but this activity is definitely necessary at all stages and stages of the project life cycle. The purpose of these activities is to maximize the effects of positive events while minimizing the consequences of negative events.

The pre-investment stage of the project is always critical, because understanding the essence of risk analysis predetermines the further success of the planned project.

Mistakes at this stage, in addition to high costs and difficulty to fix, have a huge impact on the next stages of the project cycle.

For this reason, the risks that may arise at the pre-investment stage are considered the most dangerous for investors.

Any potential obstacles at this stage should be identified and removed as soon as possible in order to protect project participants from wasteful use of resources.

Unfortunately, even a carefully prepared due diligence study does not allow to identify all the events that could negatively affect the success of the implementation and the profitability of the project. It should be remembered that a certain risk accompanies an investment project throughout its entire life cycle.

Table: Sources of investment risks at different stages of the project.

| Generating an idea and creating a project concept | Investment project planning stage | Implementation stage (engineering design, construction) | Stage of completion (delivery) of the project |

|

|

|

|

It is worth emphasizing that in the life cycle of an investment project, various threats may appear that increase the risk of its failure.

These can be financial, technical and organizational threats.

Measures to minimize investment risk in large projects

Depending on the assumptions made and the specifics of the investment project, it is possible to propose different methods of influencing the risk in order to eliminate or reduce it.Recommended strategies for investors may include the following:

• Avoiding risk by changing the way the project is implemented in a way that eliminates threats and design a version of the project with less risk.

• Reducing risk through actions aimed at minimizing the consequences and / or reducing the chance of negative events occurring.

• Minimizing risk through various actions to transfer adverse consequences and liability for consequences to another person or company.

Experts recommend that the project participants establish benchmarks by which the subsequent results of the investment project will be compared. The most appropriate moment to establish these standards is the preparation and planning of an investment project.

The most important project control parameters are as follows:

• Final and intermediate quality parameters of the project results.

• Quantitative parameters characterizing the efficiency of the investment project.

• Time standards, including the date of delivery of the object and the completion of work.

• Consumption standards for materials, labor resources, energy, etc.

• Project investment cost standards.

• Risk standards.

Proper preparation of a large investment project, which consists in carrying out all analytical studies already at the design stage, will reduce costs and significantly minimize the risk of its failure.

Risk monitoring and control are equally important. These activities allow new risks to be identified, analyzed, considered, and monitored and re-assessed.

Risk analysis methods for a large investment project

A risk analysis should be carried out for each major investment project in order to identify and eliminate any factors that may adversely affect the level of investment performance.During the planning phase, this allows the project team to develop effective ways to protect the investment.

Identification of investment risks is a key point in the entire procedure for evaluating the effectiveness of investment projects. Some experts consider it as a fundamental aspect of the multi-stage process of preparing and implementing a large investment project, regardless of localization and business area.

The importance of this issue is confirmed by a large number of research methods in this area. The choice of a risk analysis method in large investment projects usually depends on two factors. First, it is knowledge and experience in assessing the scale and likelihood of events affecting investment risk. Secondly, it is the willingness of investors to bear the costs of applying the chosen methods.

Below we have listed the most common classification of risk assessment methods that are widely used in the analysis of investment projects by European experts:

• Direct methods. This group presents methods that directly incorporate risk into the analysis of an investment project, allowing the investment decision to be made on this basis.

• Indirect methods. These methods indirectly include risks in the decision criteria, being separate elements of the decision-making process. They help the project team gain additional information about the investment risk, thereby reducing uncertainty.

In practice, there are different methods for analyzing investment risks based on sensitivity analysis, correction of project efficiency, modeling, as well as various mathematical statistical tools.

Brief description of investment risk analysis methods

The efficiency adjustment method belongs to a group of methods that directly take into account risk when assessing the efficiency of investment projects.The process of studying the influence of risk on the performance indicators in this case consists in studying the values of the selected criteria in different periods of time, but less than the planning horizon.

A study using this methodology is carried out by calculating performance indicators as the term of the investment project is shortened and the discount rate is adjusted. The formula of the efficiency correction method is based on a model that takes into account changes in uncertain parameters.

The sensitivity analysis method refers to methods that indirectly take into account risk when assessing the effectiveness of investment projects. The method is used to visualize the degree of sensitivity of the project to independent changes in individual elements. It illustrates the impact of these changes on ROI, including the project's break-even point.

Sensitivity analysis examines the effect of deviations in one variable on the profitability of an investment project (NPV or IRR), provided that there are no deviations in other variables.

This tool can be used for an isolated assessment of various aspects of an investment project, such as financial leverage, project margin of safety, and so on.

Unfortunately, sensitivity analysis sometimes produces mixed results, making interpretation difficult. According to some studies, the assessment of individual project scenarios can be completely different depending on the interpreter.

For this reason, sensitivity analysis should not be used as the main method of risk analysis for large investment projects, being just an introduction to proper risk analysis using advanced methods.

Statistical methods for analyzing the risk of an investment project indirectly take into account risks. Statistical methods are based on calculating probabilities using statistical tools. They are used to study the risk associated with the formation of the structure of cash flows throughout the entire life cycle of the project.

The classification of statistical instruments used in these methods directly depends on the positive or negative nature of the investment risk.

When the project team analyzes negative risks, different probabilistic indicators are usually used.

For a broader approach to risk analysis, variance and standard deviation are used.

It is obvious that the effective use of these tools requires the specialist to have a profound meaning of statistics. These methods are much more complex than sensitivity analysis. However, statistical methods are extremely effective when it is necessary to compare several investment projects and choose the best one.

Modeling methods allow us to understand the simultaneous influence of all correlated variables on the efficiency of an investment project with a clear illustration of risk. The essence of these methods lies in the use of probabilistic and statistical tools for the accurate modeling of the investment cycle.

Modeling methods can be used as part of financial analysis for large investment projects that are subject to high uncertainty and require determining the likelihood of achieving a given level of efficiency.

An example is the Monte Carlo method, which takes into account the simultaneous effect of various variables on the profitability of a large project.

However, the number of recommended simulations is limited to three options (pessimistic, most probable and optimistic), with the simultaneous assumption of three levels of parameter deviation (maximum, expected and minimum).

Moreover, for each of the three simulations, project performance calculations are performed using the same measurement method.

Currently, a wide range of tools and models for analyzing the risks of investment projects have been developed, which allow high-quality planning of large investments in different industries.

If you are interested in project financing services and project management, please contact us at any time.