Financial modeling for investment and business projects

Skywalk Investment Group offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

Skywalk Investment Group is ready to offer long-term financing for new business projects on flexible terms.

We also offer large companies comprehensive financial modeling and consulting services.

The essence of financial modeling

Financial modeling has some common features with the concept of financial planning, which can be viewed as a projection of economic processes in monetary terms.The above definition is broad and covers planning both at the macroeconomic level and at the level of a specific investment project or company.

Any financial model includes the most important factors of economic processes and the relationship between them, reflecting these factors and relationships in monetary terms. Financial modeling assumes a systematic approach to investment project management, covering all areas of business activity.

Financial modeling is critical to evaluating any business model.

The goal of financial modeling is to answer the question of whether a new business project can provide adequate return on equity and create sufficient value for the owners of the company.

Over the years, many financial modeling tools have been developed, such as forecasting methods, capital budgeting methods, company assessment methods, risk assessment methods, and so on.

Some of these methods can be successfully used to analyze a specific business model from a value creation perspective. However, these methods should be adapted to the requirements of each investment project and the needs of the client.

Financial modeling is the quantification of the goals to be achieved in a new business project.

A quantitative assessment of these goals is reflected in the form of various types of financial forecasts.

The structure of the financial model must match the structure of the business model:

• The structure of the business proposal addressed to customers.

• The structure of the value chain, where the resources used and relationships with partners predetermine the structure of investment costs, operating costs and the company's need for working capital.

• The structure of financing investment costs, determined by the need for long-term capital, methods of obtaining it and the cost of financing.

The structure of a specific financial model is determined by the structure of the corresponding business model, its goals and development forecasts.

European financial experts distinguish the following types of financial models in this context:

• Real Estate Model.

• Corporate Model.

• Project Finance Model.

• Financial Institution Model.

• Acquisition Model.

• Merger Model.

The presented list can be supplemented with a financial model related to a new business project.

It demonstrates some similarities with a financial model for an existing business, as well as a financial model for a new investment project.

Features of new investment projects

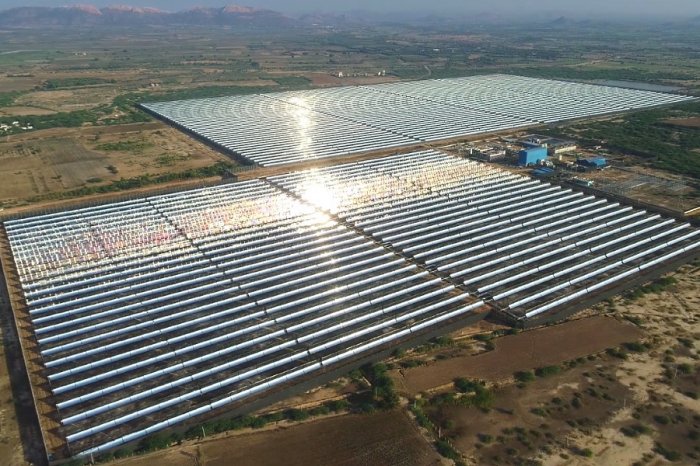

In the case of financing and evaluating the effectiveness of investment projects, the latter can be classified into two large groups.Firstly, these are projects that are associated with an increase in the scale of activity or entering new markets with existing products and services (for example, the construction of new factories or power plants).

Secondly, it can be investment "exchange" projects, where existing resources (including fixed assets) are replaced with more efficient ones.

The financial model for a new business project has the following important features:

| Features | Detailed description |

| High level of risk | The risk associated with the implementation of a new business project, especially based on innovation, is usually higher than in the case of investment projects that involve expanding the company's current activities through extensive growth of production capacity and entering new markets with an existing product. This risk can significantly exceed the risks of the current operations of the company, which is seeking to update its business model. |

| Financing structure | The financing structure of a new business project can change significantly over time, as in the case of long-term investment projects implemented in the framework of project finance (PF). In contrast to the financing structure of an existing business, a new project at an early stage of development is usually funded with equity, sometimes with capital received from investors who take a high level of risk (for example, venture capital funds). Raising debt capital is simplified only after the new company is consolidated in the market and the corresponding reduction in investment risks. However, a company with a strong market position intending to implement an investment project with the same level of risk can usually finance it in whole or in part with borrowed capital from the very beginning. |

| Project lifespan | The duration of an investment project is usually strictly defined and is determined by the period of use of fixed assets. This statement applies in particular to infrastructure projects. The duration of a new business project is difficult to predict as it depends on variable factors, including technological progress, competitors, and more. |

| Financial schedule | The timing of achieving financial performance and stable cash flows differs depending on the financial models drawn up for the existing enterprise (investment project) and for the new business model. In the latter case, it is always possible to distinguish several stages of changes in its financial results, ranging from a phase of moderate growth to a phase of decline after the emergence of new models. But in the case of infrastructure projects, the boundaries of these stages are often less clear-cut. |

| Lack of historical basis for forecasting | In the case of developing a financial model for an investment project or a new business model, the team does not have historical data for forecasting, so Zero Base Budgeting (ZBB) plays an important role. On the contrary, when creating a financial model of an existing enterprise, the historical information about the results achieved earlier is the starting point for forecasting. |

| The role of modeling | The role of financial modeling in evaluating an investment project most often comes down to determining its profitability using specific indicators (for example, NPV, IRR and payback period). In the case of developing a new business project, the financial model plays a broader role. |

The aforementioned similarities and differences between financial modeling for evaluating a new investment project or an existing company (business model) significantly affect the approach to developing financial forecasts, the choice of funding sources, the cost of capital and the choice of criteria for assessing business performance.

This iterative approach to developing a business model using financial modeling enables companies to better tailor their offerings to customer expectations, as well as develop their value chain and business financing tools more efficiently.

Development of a financial model for new investment and business projects

The design and structure of the business model determines the structure of the applicable financial model, which is usually generated using a spreadsheet.Some experts argue that the current concept of business modeling came with the development of spreadsheets, which greatly improved and simplified financial modeling.

An integral part of any business project is the modeling of sales revenue as well as the value chain. In each case, financial modeling is usually preceded by a series of studies or processes adapted to the requirements of modern strategic management and business planning. Both revenue and value chain models make assumptions about sales revenues, operating costs, and investment costs.

Professional assessment of various economic indicators allows a business to predict profit and loss by separating different levels of financial result, balance sheet and cash flows. These forecasts should be adjusted to meet the information needs of a particular customer.

The basis of financial modeling for new business projects should be the present value of the projected free cash flow for each of the owners of the enterprise (FCFE - Free Cash Flow to Equity).

This metric indicates whether the specified business model can generate acceptable results for them.

If the business model fails to generate satisfactory value for the business owners, there are two options.

The first is to abandon the implementation of a new business model, and the second is to develop and test a new model.

In the second case, the finance team brainstorms new decisions about the shape of the future business project and selects the most appropriate ways to finance it based on previously made forecasts of sales revenues, costs, operating expenses and other financial indicators.

As part of this process, the financial model of a future project may undergo significant changes, which usually have a positive effect on its results.

In any case, the main task of our team is to find the best solutions that provide a satisfactory level of value created for the owners.

The most appropriate financial model should be used to validate proposed ideas for redesigning the business model in terms of creating value for business owners.

Thus, professional financial modeling facilitates the iterative search for the best solutions for investors.

In subsequent iterations, new scenarios for both the business model and the financial model are created to reflect the projected results. The search for solutions is completed only when there are no further proposals for its modification, which could contribute to the creation of higher value.

Testing new business models

One of the necessary steps used in financial modeling is testing the proposed models in real conditions.The model is tested by implementing it on a small scale and evaluating the results (revenue generated, adequate capital inflows, response from potential customers and the competitive environment).

Testing a business model can reduce the risks associated with its full-scale implementation.

This is a critical milestone for the success of a large investment.

First, when testing a new business model, information is collected that can help validate the structure of the model or some of the assumptions from which it was developed. The most important thing is to get information about the reaction of customers, their advice on improving the offer, supplementing it with new elements or removing those elements that are less important and are associated with high costs.

Secondly, negative testing results (clients assess the new offer negatively, project financing cannot be obtained, the expected financial results cannot be achieved) allow the company to abandon a risky project and limit the amount of losses incurred.

Testing the developed business model requires scalability, that is, the model must be implemented in real conditions on a small scale. The results of this testing should be included in the future financial model.

If the changes add value to business owners, they should be incorporated into the version of the business model that will be implemented on a large scale. This creates an iteration that is closest to market expectations, and therefore reduces the overall investment risk.

A similar effect can be achieved through negotiations with other business partners, in-depth market research or environmental analysis.

An iterative approach to financial modeling creates the best conditions for finalizing the project before full-scale implementation, and also minimizes risks. It is especially important to choose the right sources of financing for projects, which include bank loans, bonds, share issues, etc.

The presented approach should become the main tool for analyzing and mitigating risks.

This does not mean that in subsequent iterations it is impossible to use the traditional methods of risk analysis recommended when evaluating investment projects (sensitivity analysis, decision trees, and so on).

The corporate finance literature offers a variety of methods for assessing the financial needs of projects and capital participation. In financial modeling for new business projects, income methods are most important, which are most often based on projected cash flows.

Experts identify four methods based on cash flows:

• The method based on discounting the balances of the company's free funds (FCF - Free Cash Flow).

• The method based on discounting the balances of free funds, related to all participants of financing (CCF - Capital Cash Flow).

• The method based on discounting the balances of free cash flows attributable to each owner (FCFE - Free Cash Flow to Equity).

• The method of the adjusted present value (APV - Adjusted Present Value).

In each of the above methods, the projected cash flows are the basis for the valuation of the entity and the equity holders, but the method for calculating them is slightly different.

Taking into account the aforementioned aspects of financial modeling for new business projects, the third method of assessment can be called the most appropriate. When choosing this method, the criterion for evaluating a business model in terms of creating value for owners is the present value of the projected free cash flow attributable to owners (FCFE).

The first and second valuation techniques, based on projected free cash flow available to all investors, use the Weighted Average Cost of Capital (WACC) as the discount rate.

The importance of financial modeling for business

Financial modeling enables businesses to support the development and implementation of the most appropriate business models that can create maximum value for customers and generate a satisfactory rate of return for owners.For this reason, financial modeling should be carried out in parallel with the development of an innovative business model for the future project / company.

The importance of financial modeling for new business projects is characterized by the following:

• Financial modeling is iterative in nature, so the many options presented give the customer the broadest choice.

• Financial modeling for evaluating a new business model is fundamentally different from financial modeling used for evaluating an existing company, requiring specific approaches and solutions.

• The simulation results allow the business to choose the most promising and least costly way of implementing the project using the best ways to attract investment, increasing the chances of project success.

The ability to compare different options, financial instruments and mechanisms provides tremendous benefits to investors.

If the proposed financial model indicates the impossibility of obtaining a satisfactory rate of return for the owners of the enterprise, then the design of its individual elements should be rethought.

Any change in the business model must be reflected in the financial model. Thus, the idea is tested in terms of creating value for customers as well as for the owners of the company. The financial model, reflecting the financial effects of a new business project, guarantees a comprehensive and systematic approach to its development.

If you are looking for professional financial services or need financing for large investment projects, contact Skywalk Investment Group.

An international financial company with an impeccable reputation and a vast geography is ready to help in the implementation of the most daring business projects in the energy, oil and gas sector, infrastructure, heavy industry, agriculture, tourism and other areas.