To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Investment loans, combined project finance (PF) schemes, bond issues - financing options for large-scale energy projects are extremely diverse.

Banks are showing strong interest in investing in the renewable energy sector amid a clear decline in interest in coal projects around the world.

However, each business has unique requirements, which is why our team is open to any project.

The international company SWIG (Spain) offers a full range of financial and engineering services for energy companies, including financing of energy projects, construction of power plants, substations and power lines under an EPC contract.

SWIG funds the following projects:

• Construction and modernization of thermal power plants.

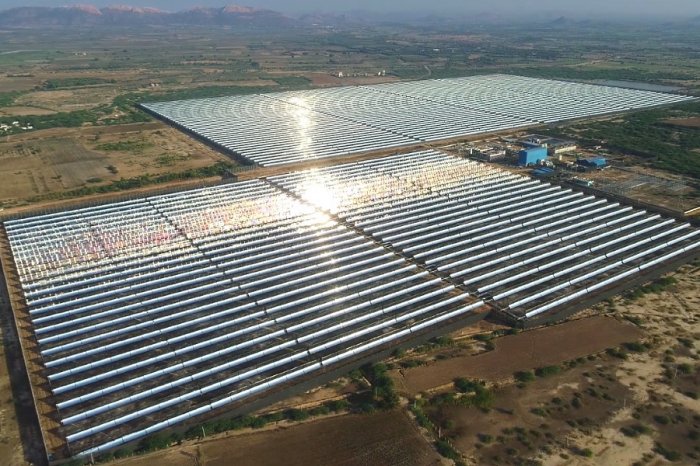

• Construction of solar power plants of all types (PV and CSP).

• Construction and modernization of hydroelectric power plants.

• Construction of geothermal power plants.

• Construction of electrical substations.

• Laying of transmission lines, etc.

Contact our consultants at any time for details.

Traditional sources of financing for large-scale energy projects

Over the past decades, the energy sector, due to its strategic nature, has attracted significant private investment and bank loans. Most large companies in the sector raise funds primarily through project finance instruments or investment loans.Traditional corporate financing is used when the amount of investment is adequate to the current scale and activities of the company.

In this case, the net debt / EBITDA ratio usually does not exceed 3 throughout the entire financing period.

Corporate finance is considered the most cost effective financing option. It also gives more flexibility and reliable access to funds, since the bank guarantees the repayment of the debt based on the results of the analysis of the financial performance of the borrower.

The 2008 crisis has increased the caution of commercial banks in providing loans, including investment loans to finance large energy projects. Caution is still expressed in increased requirements for borrowers, higher interest rates and shorter loan terms.

Currently, due to a slowdown in the economy and uncertainty due to the pandemic, financial institutions are still wary of large-scale projects with a long funding period.

However, in cases where the financing period exceeds 7-8 years, certain elements of project finance are usually integrated into the corporate finance structure, and in some cases, financing is carried out according to the PF formula.

The high risk of investors associated with the preparation of project finance models contributes to the attractiveness of traditional methods of business financing.

There are currently few energy projects in the world that exceed the recommended net debt / EBITDA ratio.

Therefore, both energy companies and banks prefer a corporate finance model that avoids complex PF procedures and reduces costs.

To a large extent, the choice depends on the specific company. For example, young companies with large ambitious projects cannot obtain sufficient loans under the traditional scheme, therefore they are forced to use PF.

The possibility of traditional financing largely depends on the borrowing company.

The more assets a company has, the higher its ability to generate EBITDA.

Thus, large energy groups have much more opportunities to obtain loans. European experience shows that very large funds can be obtained in this way. Large companies in Poland, Spain, Germany and other countries are announcing multi-million dollar bond programs.

Corporate finance instruments are now relatively cheap and simple.

This is evidenced by the fact that the current supply of banks in financing the energy sector based on the borrower's balance sheet exceeds the needs.

However, banks to protect their interests use separate contractual provisions, to some extent limiting the activities of the borrower. Restrictions usually apply to lending, guarantees, collateral, ownership structure, etc. These restrictions usually apply to the entire energy group.

The situation is completely different with project finance. Although the structure of the PF contractual relationship is much more complex, the restrictions mainly apply to special purpose vehicles (SPVs) and to a lesser extent affect the activities of the initiating company.

Sometimes a loan is considered as bridge financing for a specific investment period.

Ultimately, the part of the enterprise that has already been put into operation can be classified as an SPV and refinanced with a long-term loan provided by the bank directly for the SPV.

From the point of view of financial institutions, this practice minimizes the risks associated with the investment process. This ensures the safety of lenders and allows investors to save time and costs associated with bank supervision of the investment process and risk assessment of contractors. In addition, since the loan refinances a finished project, which does not entail additional risks associated with the investment process, it can be provided on much more favorable terms compared to standard contracts.

As mentioned earlier, the ability to obtain financing based on traditional models is limited by the ratio of net debt to EBITDA.

In the short to medium term, energy companies should have no problem with such financing.

However, as the need for financing large-scale energy projects is increasing, this model will soon fail to provide the required investments in the energy sector to maintain sustainable power generation and modernize distribution networks.

As a result, even the most powerful companies have to look for alternative long-term financing instruments.

Table: Comparison of internal and external sources of funding.

| Internal funding sources | External sources of funding |

|

|

Energy project finance

Projects that are more costly than the company's current assets require project finance.This financing formula is also chosen to limit the risk borne by the project sponsor and in case of attracting a large number of investors.

The PF is based on the assumption that the debts will be fully repaid from the funds received from the project. In the European energy market, this approach has been widely used to finance wind farms. Preparations for financing large-scale energy projects can take up to several years, especially if the initiator invites a wide range of participants.

Financing energy projects includes the following stages:

• Development of a project concept and, in the case of attracting a large number of investors, establishing clear rules for their future cooperation.

• Carrying out a feasibility study taking into account all aspects of the project.

• Obtaining appropriate licenses and permits, negotiating concessions, etc.

• Analysis of the environmental impact of the future facility and obtaining environmental permits, as well as negotiations with the local community.

• Development and approval of technical and commercial documentation, preparation of a tender and signing an agreement with the general contractor (EPC contract).

• Obtaining funding for the project.

In the case of large projects requiring funding from several or even a dozen financial institutions, the initiator usually hires a financial consulting team to make decisions.

Such projects require a lot of research and negotiations with the participants.

The SWIG finance team is ready to provide clients with various financing options for an energy project, helping to organize and coordinate financing. Both the initiator of the project and banks and investors cooperate with specialized companies responsible for due diligence.

When it comes to the energy sector, potential investors should additionally conduct technical analysis in accordance with accepted standards.

In the case of the construction of wind farms, the list of studies includes, but is not limited to, wind regime studies, environmental studies, market analyzes, as well as financial model audits, insurance and legal audits.

In project finance, any risks arising during the construction and operation of a project are usually shared between the investor, contractor and financial institutions.

The risk analysis of an energy project should take into account the following factors:

• The energy purchase agreements and their term in relation to the financing period.

• The status of a potential energy buyer and the associated market risk.

• Terms of contracts for the supply of fuel for the power plant.

• The main provisions of the EPC contract, including the level of guarantees and contractual penalties, as well as the financial health of the main contractor, his reputation and experience in similar projects.

• Power unit technology and experience of its application in other projects around the world.

• Environmental aspects associated with the implementation of investments, their potential impact on the environment and the interests of the local community.

• Regulatory aspects, etc.

Project finance can be non-recourse or with limited recourse to the borrower, including the obligation to cover unplanned construction costs, fuel supply contracts or additional support during the construction period.

Depending on the results of the sensitivity analysis and the conditions for the sale of electricity, the required amount of investment is determined, which usually ranges from 70% to 80% of the total cost of the project.

SWIG is ready to provide financing up to 90% of the cost of your project.

The PF loan is secured by the assets of a special-purpose vehicle, its shares and rights under the most important contracts. Financial institutions also enter into direct contracts with key project participants, allowing them to take over the SPV and continue the project in unforeseen circumstances.

The financial documentation for project finance is stricter and more complete than for corporate finance. Unlike traditional investment loans, where financial ratios and company reports are assessed, the PF is based on indicators related to the cash flows generated by the future project, such as the minimum and average debt-service coverage ratio (DSCR).

Thus, a key element of the success of the financing is the careful preparation of the financial model of the planned energy project.

The difficulties associated with creating such models for the energy industry are usually the result of the following factors:

• Uncertainty about the allocation of CO2 allowances as well as unpredictable prices for CO2 allowances sold on the market.

• Stricter requirements, including the requirement to use the extremely expensive CCS (CO2 capture and storage) technology in coal-fired power plants.

• Unstable legal regulation in the field of energy in many countries of the world.

• Rapid evolution of technology, which leads to a change in the energy market.

• Unpredictable fuel and electricity prices.

The financing period for energy projects carried out by commercial banks is usually 8-15 years, with debt repayment largely in line with the cash flows generated by the project. By engaging an experienced financial team, these conditions can be tailored to a specific project.

Investment loans for energy projects

The needs for long-term investment in the energy sector in Europe, East Asia and Latin America are enormous.The question is how to find the most convenient funding sources for numerous projects.

Technological and regulatory uncertainty, which determines the hardly predictable efficiency of investment projects in the energy sector, remains a very serious problem for the market. The tightening of restrictions in the banking system is also becoming an important obstacle.

Although the best projects will find their place even in adverse conditions, the success of the vast majority of investments will depend on the stability of the regulatory framework and the right choice of financial solutions.

Sources of long-term financing of energy projects, in addition to the issue of securities (shares, corporate bonds) and leasing, is an investment loan. Companies use it as their primary source of funds for capital intensive projects.

An investment loan is a type of bank loan provided to finance investments aimed at increasing the value of a company's fixed assets.

Typically, this loan is issued for a period of several years to two decades or more.

Funds received under an investment loan can be used in different ways. They are most often used to buy new fixed assets such as cars, machinery, devices or equipment. They can also be used to buy, build, expand, add or upgrade commercial properties, or lease equipment.

Loan funds do not have to be used only for investments in tangible assets.

They can also be a source of financing for the purchase of securities, shares of other companies, intangible assets (know-how, patents, licenses).

Banks are willing to invest in the energy sector, which generates stable cash flows and has good prospects for the future. However, the large number of applications does not mean that all of them will be approved.

The second factor that requires a cautious approach to energy investment is the uncertain future direction of this sector.

Will it be renewable energy?

Maybe coal or nuclear power?

Or shale gas thermal power plants?

Experts believe that project financing is a risky decision in turbulent times. In this case, only effective system solutions are able to ensure the success of investments and the possibility of repayment of the project debt.

For this reason, investment loans for the construction of power plants and other large-scale energy projects continue to be an important tool.

Banks are willing to finance promising projects initiated by well-known energy companies with good financial reporting.

Syndicated investment loans are also in high demand for the largest projects.

Consortia are usually formed by banks that have previously collaborated on various investment projects. Sometimes they include small financial institutions or banks that do not work in the energy sector on a permanent basis.

Project initiators should carefully consider what kind of financial partners they want to see in their project.

Situations vary, and it is very important for energy companies to provide a strategy at all stages of the investment process, including the operation and maintenance of a new facility.

The energy sector needs long-term thinking and strong partnerships.

The international company LBFL is ready to become your reliable partner in Europe and beyond.

Are you looking for financing for energy projects?

Contact us at any time.