To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

The development of such projects requires significant capital expenditures for planning and designing, purchasing and installing equipment, as well as training or hiring personnel to operate and maintain the installed systems.

This is especially true when it comes to geothermal power plants or other advanced technologies.

They are perceived by financial institutions as high-risk investments and, therefore, companies have limited access to finance.

Some difficulties in financing renewable energy projects:

• High initial investment compared to other traditional energy sources.

• Biased attitude towards RES as projects with high investment and operational risk.

• Constant changes in the regulatory framework and associated uncertainty.

• Lack of experience in financing RES and poor culture of asset-based finance.

• A narrow circle of contractors implementing large projects in this area.

All of the above issues determine the low availability of funding for this type of project.

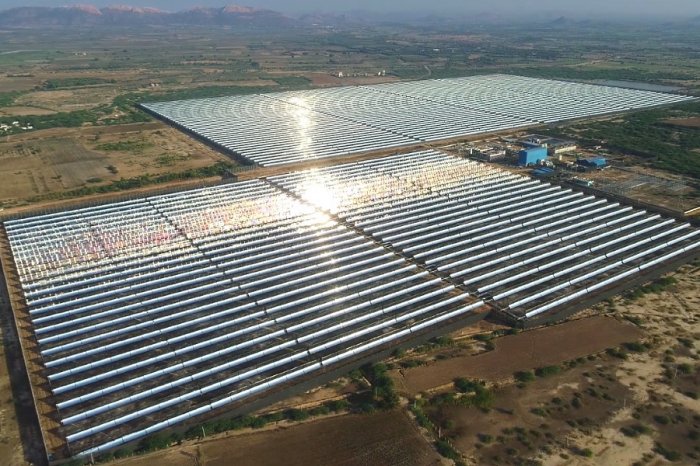

The international company LBFL is ready to offer its clients financing of large renewable energy projects, including investment loans for the construction of solar power plants, wind farms, hydroelectric power plants, substations, etc.

We also offer a wide range of financial, legal and engineering services to solve any problem for your business.

Contact us to find out more!

Financing renewable energy projects: available options

In general, there are three main types of financing - equity capital, investment lending and grant financing.Grant financing, common in European countries, is hardly used in developing countries. Investment loans remain the main sources of funds for domestic energy companies.

Equity capital

Energy companies can raise funds from investors in exchange for shares.This entails the highest risk, as equity investors are only allowed to distribute the dividends received after all financial and tax obligations have been met.

Investors expect a high return on investment. On the other hand, investing in shares implies ownership and the right to participate in decision-making.

From the point of view of the implementation of an energy project, money can be attracted in the form of investment loans and various project finance schemes. In the case of a loan, the borrowed funds must be repaid, albeit with flexible repayment terms.

Mezzanine financing

Mezzanine financing (mezzanine) is an effective debt instrument intermediate between bank lending and equity capital.By definition, mezzanine funds are investments in an energy project with subsequent participation in business under certain conditions, for example, after the commissioning of a power plant. This scheme is considered impractical for most projects, therefore it is rarely used by companies when there are no other options for financing the project.

For his part, the investor assumes a significant risk, because the project may not be completed at all. In return, the investor expects high returns to offset this risk.

Usually mezzanine financing is provided for large projects.

Investment lending

In recent years, investment loans for the construction of solar power plants and other renewable energy projects have gained tremendous importance for the industry.Debt financing consists of obtaining a loan or issuing bonds to raise capital and requires the company to return the borrowed funds and interest. Lenders traditionally bear less risk than shareholders.

Table: Financial institutions providing loans for renewable energy projects.

| Financial institutions | Short description |

| Commercial banks | Commercial banks generally rely on market conditions to determine maturity and interest rates. They are more accessible than government and international financial institutions. |

| International banks or development banks | The European Bank for Reconstruction and Development (EBRD), the World Bank, the Inter-American Development Bank (IDB) and other institutions offer investment loans at more favorable terms than the average for commercial banks. These financial institutions often operate jointly with other banks (syndicated loans). They can offer strong guarantees that reduce project risk and allow other forms of funding to be attracted. Some of these institutions target a specific region of the world (eg IDB for Latin America). |

| State banks | State banks have high requirements for projects and usually conduct in-depth analysis of the financial performance of the borrowing company. These institutions are actively involved in the financing of strategic energy projects. |

| Investment banks and mutual funds | These financial institutions can finance large renewable energy projects by participating in equity capital (equity investors). |

As a rule, investment loans are issued with the right of recourse to the borrower, that is, the assets of the energy company are considered as collateral and can become the property of the bank if the terms of the agreement are violated.

This approach, known as asset-based finance, applies primarily to large companies with multi-million dollar assets. Young companies with serious projects often turn to so-called off-balance sheet financing.

Project finance

Project finance (PF), applicable to large-scale capital intensive energy projects, is also referred to as off-balance sheet finance.This is a long-term funding based on the future cash flows of the project and not on the current financial health of the initiators.

In this case, the assets of a special-purpose vehicle, including contracts that generate income, become a collateral. This model is of limited suitability for renewable energy projects, since the cost of selling equipment (collateral) of such facilities can be low.

A special purpose vehicle (SPV) isolates the project risk from the initiator's assets. It is a legal entity created to separate cash flows and venture risk. The creation of an SPV implies fixed costs that are considered appropriate only for large projects.

Financing the RES sector through leasing

Leasing for renewable energy projects remains popular, gradually becoming more complex and acquiring new forms of contractual relationships.There are two fundamentally different leasing options with their pros and cons.

If the leasing company retains ownership, it is an operating lease. If ownership passes to the buyer, this is called a finance or capital lease.

In both cases, the payments fully cover the cost of the leasing company's equipment minus a small residual value, interest plus insurance costs and profits.

Operating leases are not reported on the company's balance sheet and lease payments are recognized as an expense in the income statement. In the case of finance leases, the lessee must disclose the leased equipment on its balance sheet as assets and the present value of the lease payments as debt. Some finance lease programs allow a client to purchase an item at the end of the lease term.

Supplier investment financing

Investment financing of renewable energy projects by equipment and service providers becomes possible when the financing organization provides the supplier with capital that allows him to sell products without immediate payment.This method of financing large projects allows the manufacturer to supply the necessary equipment to the company in advance, receiving payment on a pre-agreed payment schedule, in accordance with the cash flows of the future project. Leasing is the most common form of supplier financing for projects.

Entrepreneurs often use factoring to support ongoing financial activities or to overcome potential disbursements.

Meanwhile, factoring is a service that works as a source of investment financing.

The main role of factoring is to finance the client's business. In many European countries, such as the UK or Italy, factoring is widely recognized as a way to reduce risk in doing business, as well as a tool to support projects.

Companies turn to factoring for help in obtaining funds for the construction and modernization of energy facilities. As a rule, such companies do not have the opportunity to obtain an investment loan due to one reason or another.

Bonds

Another important debt instrument is bond financing.These are fixed-term securities issued by corporations or governments that entitle the bondholder to receive principal and interest.

It is difficult to structure the financing of renewable energy projects by issuing bonds. In this regard, it is important for companies to minimize or eliminate construction or technological risks. An example of bond financing suitable for renewable energy projects is the issuance of municipal bonds for local energy projects.

Grants for strategic projects

Grants for the implementation of strategic renewable energy projects do not require payment.They are usually allocated by governments and international organizations to promote environmental and economic development projects.

Allocated funds are often tied to the specific requirements, conditions of use and time constraints of the project. Grants are often used as an incentive to make attractive investments in new markets or in projects for which economic benefits have not been proven. Government subsidies take the form of soft loans, tax cuts, etc.

In general, taxation can be a powerful tool to stimulate renewable energy and energy efficiency projects by providing tax incentives, capital gains tax cuts, property taxes, VAT and accelerated depreciation schemes.

The participation of states and international organizations in the development of renewable energy sources is not limited to subsidizing innovative projects.

This activity is currently systematic and is widely carried out around the world.

Recently, the International Renewable Energy Agency (IRENA), together with its partners, the United Nations Sustainable Energy for All (SEforAll) initiative and the UN Development Program (UNDP), launched a Climate Investment Platform to increase financing for renewable energy in developing countries. countries and accelerate the achievement of the global climate goals.

Investment loans for energy projects from LBFL

Every company should take care of continuous development in order to stay on the market and increase its capital.It is necessary to attract additional investments, for example, in new equipment or technologies that will meet modern requirements or overtake competitors.

However, not every company has sufficient resources.

Therefore, business owners are looking for the best solution, which can be a large investment loan.

SWIG offers the following financing conditions:

• Loan maturity up to 20 years.

• Financing up to 90% of the planned project cost.

• Provision of borrowed funds in tranches.

• Easy access for young companies.

Making rational investment decisions in renewable energy projects is a challenging business task.

Making such decisions requires a thorough Life Cycle Cost Analysis (LCCA) of the project coupled with a professional comparison of available financing options.

Company policymakers should focus on well-known financing schemes without considering alternative instruments that can significantly add value to the investment project.

Are you interested in financing renewable energy projects?

Are you looking for an investment loan on favorable terms?

Contact the SWIG finance team for a preliminary consultation.