To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

These decisions relate to the use of profits, the attraction of borrowed funds and the repayment of loans, as well as the creation of an optimal capital structure.

The most important indicators of the effectiveness of long-term financial decisions are the cost of capital and financial leverage.

Thus, the rate of return on invested capital must be higher than the cost of capital attracted. Increasing the value of the business for its owners is the long-term goal of the decisions being made.

Companies pursuing their first major investment projects may require professional support in investment engineering, financial modeling and project management.

Skywalk Investment Group is ready to offer long-term loans and project financing, as well as provide comprehensive consulting services for large businesses around the world.

Theoretical bases of financial decisions

A decision can be interpreted as a conscious and non-random choice of one of the options for action (alternatives).The decision making process in investment practice includes the following:

• Recognition and definition of the current situation.

• Search and identification of alternative courses of action.

• Selection of the best alternative and its implementation.

• Approval of final decisions by managers.

Making investment decisions is related to project management and can be considered as part of it.

Project management is a set of activities that include planning, decision making, organizing, directing and controlling projects (primarily commercial ones). An effective management system requires making the right decisions. "Right" means bringing expected results.

Financing is a process of making changes to equity.

Financing can be divided into passive, which consists in raising capital, and active financing, which includes all activities aimed at acquiring long-term and short-term capital.

This includes any activity aimed at maintaining liquidity, cost control, preparation of financial documentation and statements.

Financial management of the company consists in acquiring sources of financing for the company's activities (capital) and placing them in such a way as to achieve the strategic financial goal. This goal is ultimately to maximize the benefits for owners and increase the value of the business.

These decisions cover two areas.

The first covers the management of the financial structure and consists in making decisions in the field of raising capital, in particular the ratio of equity and borrowed capital (debt). Decisions to increase the share of equity capital increase the share of the most sustainable sources of financing, but contribute to processes such as splitting and changing the structure of equity capital, as well as increasing costs as a result of the issuance of securities. On the other hand, the decision to increase the share of borrowed capital is associated with the problem of borrowing terms.

This is critical for determining debt servicing costs and planning for future financing needs, as long-term financing is very different from working capital financing.

The second area covers asset structure management. The purpose of the decisions made is to increase or decrease the value of certain types of assets (fixed assets, working capital). The decision to increase assets often leads to an increase in the company's production potential, but forces management to look for additional sources of financing.

On the other hand, the decision to reduce the value of assets as a result of their liquidation allows the company to increase financial resources, but may limit the production potential. Time, risk and financial decisions are the main categories on which the modern theory of financial management is based.

The tasks of financial management include:

• Financial planning (budgeting).

• Implementation of the financial plan (search and attraction of funds).

• Monitoring the implementation of the approved financial plan.

Proper management of financial resources is an important factor supporting other areas of business management, including strategic management, investment project management and operational management. For this reason, long-term financial decisions are critical to investment practice.

The tasks of financial management include, but are not limited to:

• Increasing profits, which is necessary for the development of the company.

• Maximization of business value for owners (shareholders).

• Payment of debt related to investment activities.

• Maintaining the company's liquidity.

Solvency is always associated with financial liquidity.

The loss or reduction of liquidity jeopardizes the company's ability to generate profits as the profitability of the business deteriorates. Another problem is to reduce the flexibility of management actions when making decisions. There is also a risk of loss of investor interest and deterioration of the company's market position.

Financial decision-making should be based on the principles of minimizing risk, improving the ratio of income / risk, analysis of cash flows, choosing the best investment alternatives and control.

Long-term financial decisions in financial management

Financial management is the process of making three types of decisions: operational, investment and financial.This classification follows from the usual definitions used in cash flow statements.

The so-called operational decisions involve the management of the current financial performance, including revenue, costs, profits, as well as the current cash flow and liquidity of the company.

Operational solutions include:

• Approval of financing parameters.

• Planning the level of profitability of the business activity.

• Development and adoption of a program for the current activities of the company.

• Finding ways to ensure the company's current obligations.

• Seeking surplus cash for short-term investments.

Investment decisions are related to the allocation of capital.

This group of solutions includes:

• Decisions related to tangible fixed assets.

• Decisions related to financial fixed / current assets.

The subject of financial decisions is the choice of sources of financing for the current (operational) and investment activities of the company. In other words, these are capital raising decisions.

Financing decisions include decisions to increase equity capital, use profits, attract loans, as well as decisions that create the so-called optimal capital structure.

The main indicators for evaluating the effectiveness of these decisions are the cost of capital and the degree of financial leverage (DFL).

Table: Types of financial decisions depending on cash flows.

| Decisions leading to cash inflows and an increase in the capital of the company | Decisions leading to cash outflows and a decrease in the capital of the company |

| Obtaining loans from banks | Repayment of loans |

| Attracting loans from other institutions | Redemption of debt securities |

| Issuance of debt securities for the domestic and foreign financial markets | Payments on other obligations of the company |

| Use of subordinated debt instruments | Payments under finance lease agreements |

| Proceeds from the shares and contributions to the authorized capital | Decrease in subordinated debt |

| Other financial inflows | Dividends and other payments to owners |

| Repurchase of the company's own shares | |

| Other financial expenses |

Financial activity concerns the acquisition / repayment of debt obligations.

These are transactions with shareholders, banks and other creditors. Both operating, investment and financial decisions are important to achieve the company's goals.

We can only talk about a certain sequence of them.

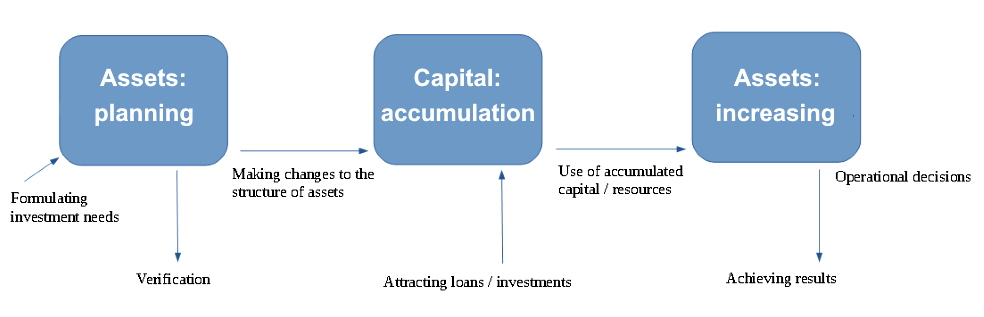

The financial management process begins with the formulation of needs, i.e. opportunities for starting a business, and continues with a decision to change the structure and level of assets. Of course, these plans are associated with different funding opportunities and conditions.

Investment decisions (identification of needs) are a prerequisite for making financial decisions. The accumulated capital allows making repeated investment decisions, and then operational decisions that determine the implementation of the entity's core business. Operational decisions affect outcomes and flows. Forming expenses and income, the company generates a financial result, which is a part of equity capital, so we influence the capital structure. The high value of positive cash flows from operating activities allows making new investment decisions.

Investment decisions determine the scale and structure of the tangible assets required to run a business.

Investment decisions also have an impact on the size and structure of financial assets (financial investments). There is a close relationship between investment and financial decisions.

Investment decisions concern the use of capital.

Financing decisions concern obtaining sources of financing for these assets (size, types and structure).

They relate to the choice of types and structure of sources of financing, the cost of alternative ways of financing planned investments and the structure of capital, including the share of equity capital formed through the reinvestment.

Short-term financial decisions can be called operating decisions if they cover a period of up to 1 year.

The purpose of these decisions is to obtain the maximum possible effect with the existing business profile and a stable capital structure. Long-term financial decisions relate to investment practices. All decisions related to raising capital, repaying debts and using funds for operating and investment activities will be of a financial nature.

Financial decisions are made on the basis of various preliminary plans, contracts, calculations and analyses.

The effectiveness of financial decisions depends on their correctness and completeness.

Financial decisions are reflected in the company's balance sheet.

Fixed assets (their value and changes) form the area of investment decisions, current assets form the area of operational decisions, and equity and debt capital make up financial decisions.

Need support for your project?

Skywalk Investment Group provides long-term financing for large projects around the world, organizes project finance schemes, and also provides EPC contracting services together with reputable international partners.

Our team is ready to provide your business with professional services in project management, financial modeling, investment engineering and consulting.