To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

In this way, large-scale national and international projects are often financed, such as chemical plants, refineries, LNG terminals, pipelines, in which different project participants jointly implement a project.

Project finance is used when the classic corporate finance approach is not possible, for example, due to economic constraints, financial difficulties of project stakeholders, the balance sheet situation of the project sponsor, and other factors.

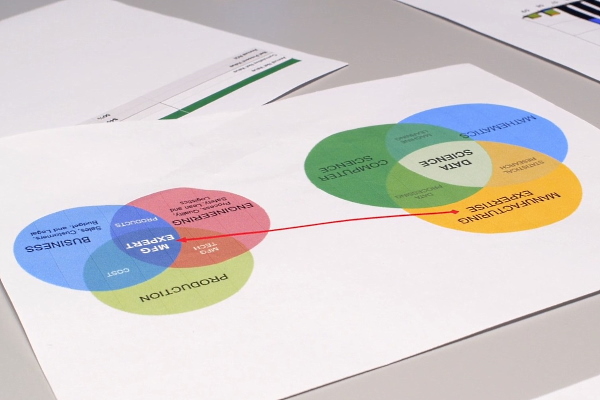

For the implementation of large energy projects, a legally and economically independent project company (SPV or SPC, Special Purpose Company) is usually established.

The equity capital is provided by the project sponsors (mainly institutional investors), while the borrowed funds are raised by the company from other sources.

This approach, in particular, is applied in the construction and expansion of solar power plants and wind farms, which usually consist of several phases, each of which can cost tens and hundreds of millions of euros and require an individual approach to financing. Each project can be carried out through the SPC, which is created specifically for this purpose. The bank provides the company with a large long-term loan, which is repaid after the commissioning of the power plant from its cash flows.

One of the advantages of project finance is that energy companies can limit the risk and project debt repayment obligations.

Table: Key features of project finance in the energy sector.

| Features | Brief description |

| Lending based on cash flows | All obligations of the project company (operational costs, interest and repayment) are covered by the future free cash flow of the energy project, which means the difference between incoming and outgoing flows, taking into account replacement investments. PF lending is based on proof of the technical and economic viability of the project. In the absence of collateral, creditors are provided with special rights, such as the right to enter into contracts, the right to participate in the management and control of SPC. |

| Off-balance sheet financing | Because project sponsors are not required to consolidate their balance sheets, project finance does not expose these participants to risk. Received loans are considered only SPC and thus do not worsen their financial performance. Sponsors' obligations are limited to their contribution to the project and assets owned by SPC (the so-called non-recourse financing). In most cases, additional obligations are assumed, for example, in the form of guarantees or obligations to make additional payments (limited recourse financing). |

| Rational distribution of risks. | Energy project risks are shared among various project participants (sponsors, suppliers, operators, buyers, lenders, project company, insurance companies). For export shipments of equipment and cross-border services, insurance policies are often issued to hedge risks. Depending on the situation, there are also guarantees from the government, public banks or supranational institutions (including European Investment Bank). |

Due to high project costs, long-term loans are often provided through banking syndicates.

Financing the construction of power plants under the PF scheme is usually long-term (15 years or more), taking into account the expected cash flows. The funds received are initially used to support the project, then the interest and principal are paid to the creditors, and finally the remaining funds are distributed to the capital providers.

In addition to lending, companies in the energy sector actively use bond issues and support from government or international financial institutions. In order to reduce the burden on government budgets, many countries are trying to involve private companies in the expansion and modernization of the energy sector through PPP projects.

As the experience of recent decades shows, in these cases, various project finance models also play an important role.

Rich experience of the project participants, clear planning of the construction schedule, legally impeccable contracts and sufficient financial reserves have a positive effect on project finance schemes.

It is also important that the calculation of the profitability of the project demonstrates a sufficient surplus of funds under any stress scenarios. This requires a reasonable forecast of expected cash flows.

Finally, lenders look to the credit ratings of project participants, including the project operator, equipment manufacturers, engineering companies, and energy buyers.

Project finance is a demanding financing option that makes economic sense only for projects worth at least 20-30 million euros.

The PF offer is intended primarily for large companies, as well as medium-sized companies with an international focus in the infrastructure and energy sectors.

When professionally organized, the PF allows companies to implement energy projects in countries with high political or economic risks, including the Middle East, Eastern Europe, South and Central America, as well as African countries.

Currently, international financial institutions often register new applications for projects in the energy sector, including onshore wind farms, solar photovoltaic projects, etc.

Officially, there is no minimum cost for each project, but in reality, project finance only makes sense for large energy projects.

ESFS Investment Group has an experienced multidisciplinary team specializing in financing large projects in the energy sector.

We are ready to offer clients flexible lending schemes, including project finance for the construction of power plants, electrical substations, power lines and other electrical infrastructure.

To find out more, contact our consultants.