Project finance and lending for mineral fertilizer plants

Skywalk Investment Group offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

There is also a clear tendency around the world to increase state support for agriculture and fertilizer production, especially in the context of ensuring food security, combating poverty, and overcoming climate change and others.

Project finance and long-term loans for the construction of mineral fertilizer plants are risky and legally complex because the financial services offered by market participants are closely integrated with other services, such as engineering, construction services, certification, licensing, supply of resources, storage, processing, marketing, personnel training, etc.

In this sense, professional market analysis, financial modeling and building adequate value chains in the production of mineral fertilizers play a vital role in minimizing risks, as well as in financing agribusiness in general.

By 2017, the total global production of mineral fertilizers reached 204 million tons, which is 1.5 times more than in 2000.

In 2019, the global mineral fertilizer market was valued at more than $109 billion with a forecast to grow at CAGR of 3 to 4% over the medium term.

China, Russia, Canada, Belarus, USA, Germany and Saudi Arabia are considered the world's leading exporters of mineral fertilizers. Geopolitical tensions, sanctions, the changing global landscape of agriculture and the global market are adjusting forecasts, creating opportunities for investment in new projects and stimulating development of the industry in new regions.

Choosing the right financing mechanism for mineral fertilizer industry solves a wide range of challenges, including increasing long-term access to financing, improving the quality and supply of agricultural products, building long-term relationships between international contractors, and much more.

Project finance (PF), being an innovative mechanism with high financial leverage, offers new opportunities for companies initiating capital-intensive projects.

Skywalk Investment Group offers a wide range of solutions in project finance with a minimum participation of the project originator up to 10%.

We also offer long-term loans for the construction, expansion or modernization of mineral fertilizer plants and related infrastructure around the world.

Financing the construction of new mineral fertilizer plants based on advanced technologies provides an opportunity to increase the overall efficiency of agricultural production (including divisions and subsidiaries of the originator), improve the financial performance of agricultural holdings and also strengthen links between participants in value chains.

Project finance in the construction of mineral fertilizer plants

Increasing the efficiency of agricultural production is critical in agribusiness.Innovative components, including mineral fertilizers and chemical plant protection products, are of increasing importance in the agro-industrial complex.

The market of mineral fertilizers in the narrow sense consists of fertilizer producers, intermediaries and consumers (agricultural holdings). Mineral fertilizer manufacturers include a wide range of chemical and mining companies that supply the market with products containing the minerals needed for proper growth and development of crops.

The main components contained in mineral fertilizers are nitrogen, phosphorus and potassium. There are simple fertilizers containing one main nutrient component (for example, urea in the nitrogen fertilizer group), and so-called multi-component fertilizers (two-component and three-component fertilizers). In addition to nitrogen, phosphorus and potassium, crop plants also need other nutrients.

The fertilizer industry offers a diverse range of mineral products, including multi-component fertilizers (solid and liquid), containing numerous macro- and microelements in various proportions and forms.

The market offers both universal fertilizers (urea) and special fertilizers, the chemical composition of which is adapted to the needs of a particular plant or group of crops.

Obviously, the successful development of new projects in the production of mineral fertilizers requires in-depth research and market analysis, assessment of the company's resource base, access to chemical raw materials and technologies, optimization of complex supply chains, often at the international level. Building a fertilizer plant can cost investors tens to hundreds of millions of euros, requiring large long-term loans and also innovative sources of debt financing based on the future cash flows (project finance).

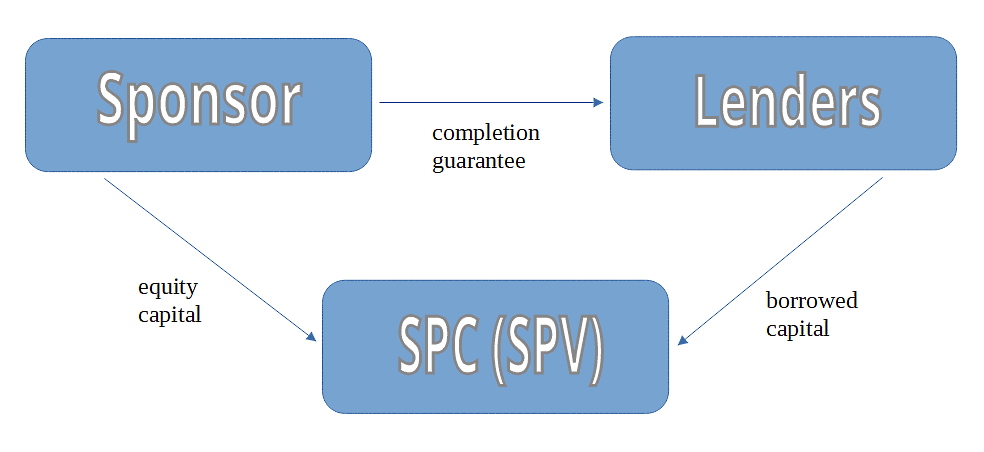

Project finance refers to long-term financing of economically independent investment projects, including large projects in the field of agriculture. To this end, an independent project company (SPC) is created for the planned investment project, which creates and manages the project and raises the necessary funds on its own behalf.

Loans for such projects are based on the economic viability of the project, which is measured based on future cash flows and the risk profiles associated with a particular investment.

In general, the creditworthiness and income of investors (sponsors) have no impact on the project. Recourse to sponsors and companies involved in the project is usually limited. A typical structure of relations between project finance participants in the schemes for the construction of mineral fertilizer plants is given below.

Fertilizer production projects carry high risks for originators and capital providers, so project finance schemes provide participants with numerous benefits, including the following:

• The PF creates conditions for the active involvement of government structures in projects to ensure the growth of agricultural production and food security.

• Governments through participation in PF schemes support strategic projects, which gives investors more peace of mind regarding the security of their funds.

• Project finance contributes to the optimal distribution of risks between the entities involved in making an investment decision, since construction costs are very high.

• The PF provides access to a wide range of financing instruments in the capital market and banking, which provides greater liquidity to projects of this type.

• Insurers participate in contracts as entities interested in providing their specialized services.

• The PF is based on a deep analysis of information on the technical, financial, legal and other aspects of projects, which is necessary for capital providers to make decisions.

• PF provides significant economies of scale.

Based on a detailed analysis of the investment project, a special financing structure is created, in which the financial potential of the project is largely used.

In other words, loans provided to SPC are primarily serviced by the project cash flows (the so-called cash flow related lending) and collateral is usually limited to project assets.

Since the sponsors are unable or unwilling to take full responsibility for the risks of the project by establishing the SPC and its debt financing, the risks of the project are shared among participants. This scheme should become acceptable to all project participants during the funding period.

Unlike classic corporate finance, where the creditworthiness of the sponsor is carefully checked, in the case of project finance, success depends on the creditworthiness of the investment project. The balance sheet of an investor company, its creditworthiness and the collateral it provides are less important than the expected return on a financed fertilizer plant project.

Given the broad scope of the mineral fertilizer industry, the term "international project finance" is often used.

This is understandable, since most of the project finance schemes involve cross-border flows of payments, chemicals, equipment, technologies and goods. Almost all integrated financial solutions are based on internationally accepted structural elements.

For example, there may be cross-border involvement of foreign companies and banks as providers of capital.

Therefore, against the backdrop of ongoing globalization and integration of economies, it can be assumed that project finance in most cases is of an international nature.

The Skywalk Investment Group team has extensive experience in organizing the financing of large investment projects, including project financing of mineral fertilizer plants in different countries of the world. We are ready to consider your project and offer the best financial solutions at any stage. Our experts also provide project management, legal support and engineering services.

Loans for the construction of mineral fertilizer plants

One of the classic options for financing the construction or modernization of mineral fertilizer plants through debt financing is a corporate loan.In corporate finance, the terms of debt repayment and the interest rate depend on the project scale, repayment terms, project risk, market situation, creditworthiness of borrowers and many other factors. The more risky the investment in a particular project, the higher the interest on the loan and the tougher the repayment terms.

A well-executed loan can be not only a valuable tool for financing the company's current operating activities, but also a source of investment financing, an integral element in the development of each enterprise. An analysis of the statistical reports of the global fertilizer industry shows that bank loans are still the most important source of external financing for companies in this sector.

Statistics show that a bank loan is one of the most preferred sources of external financing, also due to its high availability and standardized procedures.

Investment credit refers to the relationship between a lender and a borrower regarding the financing of investment activities on a repayment basis, usually with interest. Investment lending is related to real investment, which refers to an increase in fixed capital and an increase in inventories.

An investment loan has the following specific features:

• This type of loan is aimed at supporting, expanding or modernizing real production.

• The global goal of an investment loan is to stimulate economic growth.

• An investment loan refers to long-term financing, which is usually 5 years or more.

• An investment loan involves a return of funds over a long period of time, usually after a grace period that is set depending on the specific project.

• For this type of loans, a significant share of the initiators' participation in the investment project (at least 20-30% of total project cost) with a high financial leverage is required.

• The object of lending are fixed assets, as well as working capital linked with them.

• Investment lending requires a well-defined business plan, a feasibility study and contracts for the supply of purchased materials and other assets, the performance of engineering and construction works and other services.

• Sources of loan repayment include all commercial and financial activities of the operating company, including cash flows generated as a result of the implementation of the project.

• The borrower (project initiator) or the guarantor must have sufficient financial resources to service the debt in a quality manner and repay the loan provided in a timely manner.

• In addition to the provided project business plan, lenders require adequate collateral in the form of property, guarantees and warranties from third parties (including banks, government agencies, affiliated companies, co-owners of the company-borrower).

• Significant financial resources are allocated for specific purposes, which requires strict control over the use of the loan at all stages.

• Investment lending is inherent in significant risks that require their rational distribution among project participants.

Table: Comparison of short-term lending and investment lending

| Features | Short-term loans | Investment loans |

| Purpose of lending | Operating costs | Investment costs |

| Objects of lending | Current assets | Fixed assets |

| Resource type | Short term resources | Long term resources |

| Loan terms | Less than 1 year | More than 1 year |

| Forms of debt security | Pledge, guarantee, surety | Complex loan collateral, including guarantees |

| Bank income source | Loan interest | Loan interest, as well as participation in project |

| Main sources of debt repayment | All business activities and assets of the borrower | The same sources, including future cash flows of the project |

Alternative sources of project financing in mineral fertilizer industry, despite the fact that they are becoming more numerous, are still less used than bank loans.

Subsidies, financial support from EU funds and other instruments are more difficult to use than bank loans. An additional difficulty is the complicated procedure for obtaining such funds or the lack of standardization in this area.

Skywalk Investment Group, a company with an international presence, offers corporate clients around the world a full range of services for the financing of mineral fertilizer plant projects and the development of their infrastructure.

We have gathered in our team the best financial and investment experts with rich international experience.

Thanks to the well-coordinated work of our specialists and innovative financial models, Skywalk Investment Group is always ready to offer the most suitable solutions for industrial and commercial projects of any type.

Contact us to find out more.