Financing and lending for LNG plants

Skywalk Investment Group offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

This form of fossil fuel is playing an increasingly significant role in the global economy, helping dozens of countries around the world to diversify supplies and strengthen their energy independence.

The LNG industry is rightly considered to be very capital-intensive, as in addition to the cost of building infrastructure, companies incur significant transportation costs, regasification costs, tanker rental and insurance costs, and the inevitable losses of gas transported by sea.

Since LNG projects have to compete with pipeline gas in many regions of the world, all this requires a balanced and cautious approach from project initiators in choosing sources and models for financing the construction of LNG plants and other facilities.

Skywalk Investment Group specializes in financing large projects using advanced project finance tools.

We are ready to provide a long-term loan for your LNG project along with comprehensive financial and consulting support.

Whether you need immediate financial assistance, permit assistance, loan guarantees or other services, please contact us at any time.

Project investment needs and funding sources

Work on determining the economic efficiency of the LNG plant's investment project is one of the most important pre-investment stages.It includes a detailed analysis and integrated assessment of technical, economic and financial information collected and prepared in the previous stages.

All investment needs of the LNG project can be divided into direct investment, indirect investment and R&D investment. Direct investments are used directly to implement a specific project. These include investments in fixed assets (tangible and intangible assets) and working capital.

Investments in fixed assets include:

• Acquisition or manufacture of new equipment, including delivery and installation.

• Construction and reconstruction of buildings and structures.

• Modernization of existing equipment.

Investments in working capital include providing:

• Stocks of basic and auxiliary materials.

• New and additional stocks of finished products.

• Increase in accounts receivable.

The need for such investments is that when increasing the production of liquefied natural gas, companies usually have to finance increased stocks of raw materials, components and spare parts.

In addition, due to the increase in production and sales, the receivables of the company are growing. Investments in intangible assets are most often associated with the acquisition of new technology, a patent or license, a trademark in the case of a new company.

The following broad category, the so-called associated investments are made in facilities that are territorially and functionally related to the project of a particular LNG plant:

• Accompanying investments in facilities that are not technologically related to ensuring normal operation. This group includes access roads, power lines, security systems, etc.

• Non-productive strategic investments, such as investments in environmental protection, social infrastructure. This group of investments is necessary for any large LNG project to comply with legally approved standards.

Investments in research work ensure high efficiency of the project and support its implementation.

These investments primarily include material resources (compressor equipment, tanks, pipelines, electronics and various devices) needed to conduct pre-project studies. Also, this group includes working capital needed, for example, to ensure the current activities of research institutes or universities at the request of a particular company.

All sources of financial resources of the enterprise can be submitted as follows:

• Internal financial resources and material reserves.

• Borrowed funds, such as long-term investment loans.

• Raised funds received from the sale of shares and other securities.

• Funds provided by business associations.

• Funds of foreign investors.

• State budget funds.

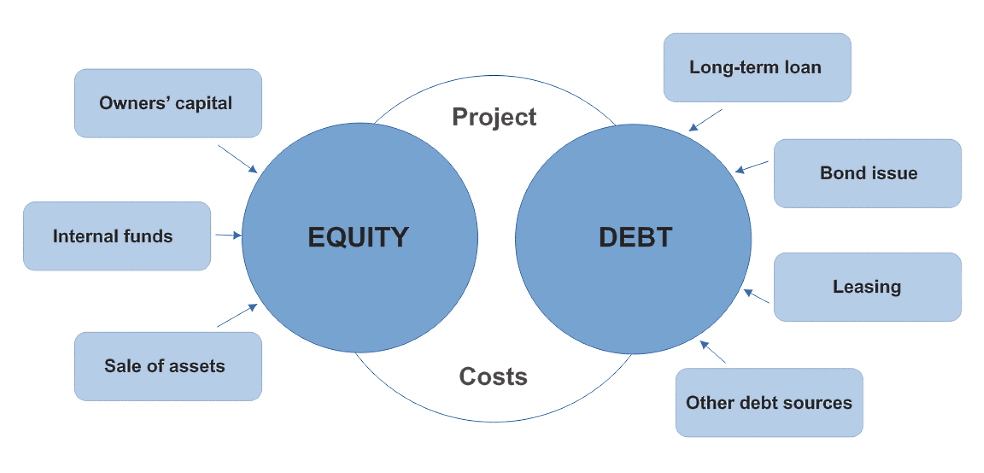

Figure: Simplified scheme of internal financial resources and loans that can be used to finance projects for the construction / modernization of LNG plants.

The mechanism of mobilization of internal financial resources of the company may consist in the allocation of current assets from the main activity and is aimed at financing capital construction.

Long-term loans, bond placement and alternative debt instruments are traditional debt financing instruments, the structure of which is shown in the figure above.

Given the high cost of equipment for LNG plants, leasing financial instruments play an important role in the construction of such facilities. If the company does not have the free funds to purchase equipment, it can apply to the leasing company. According to the concluded agreement, the leasing company fully pays the cost of the equipment to the manufacturer or owner and leases it to the buyer with the right of redemption (in case of financial leasing) at the end of the term.

Thus, the company receives a long-term loan from the leasing company, which is gradually repaid as a result of allocating lease payments to the cost of production.

Leasing allows the company to obtain equipment, start its operation without diverting large funds from current activities. In LNG projects, the use of leasing reaches up to 30% of the total amount of borrowed funds.

The main difference between equity and borrowed financial resources is that interest payments are tax deductible, ie included in gross expenses, while dividends are paid out of profits. This is a source of additional benefit of debt financing of the LNG project, as shown in the following table.

Table: Comparison of the balance sheet of two LNG projects with different sources of funding.

| Equity financing | Debt financing | |

| Total sales of LNG | 10,000,000 euros | 10,000,000 euros |

| Total production cost | 4,500,000 euros | 4,500,000 euros |

| Payment of interest on the loan | 0 | 500,000 euros |

| Value added tax (20%) | 900,000 euros | 900,000 euros |

| Gross income of LNG plant | 2,500,000 euros | 2,000,000 euros |

| Income tax (20%) | 500,000 euros | 400,000 euros |

| Dividend payment | 500,000 euros | 0 |

| Net income | 1,500,000 euros | 1,600,000 euros |

This example illustrates the so-called effect of tax savings, which explains the additional benefits of using debt financing under certain conditions.

Therefore, debt financing may be more profitable for the LNG project than equity financing. At the same time, it is more risky for the company, because interest on the loan and the bulk of the debt it must be repaid under any circumstances, regardless of the success of the particular project.

The initiator of the LNG project, seeking to reduce its risk, issues financial instruments that give ownership of the business share.

But how do you get a potential capital provider to invest in stocks when credit is less risky?

The only way is provide a higher reward for his financial resources.

Table: Matrices of profitability and risk for debt and equity financing of LNG plants.

| Profitability matrix | Financial resources | |

| Internal | External | |

| Investor | more profitable | less profitable |

| Project initiator | less profitable | more profitable |

| Risk matrix | Financial resources | |

| Internal | External | |

| Investor | more risky | less risky |

| Project initiator | less risky | more risky |

In essence, the analysis of this matrix proves the "golden rule" of investing: the greater the risk of investing, the higher the return.

This should be the starting point in the financial modeling and selection of mechanisms and sources of funding for each project.

Investment lending for the construction of liquefied natural gas plants

Investment lending can be defined as the financing of activities aimed at the acquisition, creation, reconstruction, modernization of facilities, resulting in cash flow, which provides a return of bank funds and payment for their use in accordance with the terms of the loan agreement.This type of lending is characterized by investment nature, namely:

• The object of lending is the investment activity of the borrower (LNG plant construction project), so the lender needs a detailed economic and technical justification of the financed investment measures.

• The term of an investment loan depends on the payback period of the investment, so it is usually long-term financing for a period of 10 years or more.

• An investment loan can be issued with a grace period for the construction of the facility, during which only interest is paid on the loan, and the principal amount of debt is repaid in subsequent periods.

• The interest on the loan should not exceed the level of ROI for a particular project.

Under the mechanism of investment lending means a set of actions to attract investment resources by the bank in accordance with applicable law, principles and methods of lending.

On the other hand, it involves effective management of the portfolio of existing loan agreements in order to guarantee a given level of profit and ensure timely repayment of the loan.

The choice of a particular mechanism for bank investment lending of LNG projects depends on the status of the borrower, the target nature and sources of loan repayment, loan term and amount, type of collateral, etc. When making a final decision on investment lending, it is important to establish the ultimate goal of lending, payback period and degree of risk of the project.

All of the above determines the degree of control by the lender over the financial and economic activities of the borrower and the implementation of the investment project.

The main principles of investment lending are listed below:

• Comprehensive assessment by the bank of the current creditworthiness of the borrower and analysis of changes in financial condition for a certain period.

• Determining the feasibility and effectiveness of lending to a specific LNG project. The effectiveness of investment projects is assessed on a number of principles, including return on invested capital based on cash flow, assessment of changes in the value of invested capital and cash flow, setting a differentiated interest rate when discounting cash flow for different projects.

• Development of a clear credit policy and other internal documents coordinating the actions of the bank's staff to work with loan applications and the portfolio of existing loan agreements. This presupposes the availability of specially trained staff of the bank of sufficient qualification.

• Development of a mechanism for segmentation of potential borrowers depending on the size of assets, sector, experience of cooperation with the bank, the relationship of the entity with the bank or other entities with credit indebtedness, as well as determining limits, restrictions, and special lending terms for each sector.

• Development of an adequate mechanism for identifying, assessing and managing risks.

In classical corporate financing, the primary source of repayment of term investment loans provided for the reconstruction, modernization or acquisition of the borrower's fixed assets is cash flow generated by the borrower's operating activities, and the secondary source is liquid collateral.

In this case, the object of investment lending is the borrower, not his investment intentions, so the interest rate on such a loan depends primarily on the cost of resources for the lender and the margin, but not on the level of profitability of LNG plant.

The term of the loan is set depending on the needs of a particular project, as well as on the assumption of risks by the lending institution.

An alternative approach to LNG project financing is the so-called project finance (PF). This is a specialized type of lending, in which the main source of loan repayment is the cash flow generated by the investment project.

The borrower in project finance is a specially created company (SPV / SPC), which separates the debts of the project from the balance of the initiators. Thus, this is a much riskier type of financing for creditors, which requires additional analysis and training.

You can learn more about the finance project in the construction and modernization of liquefied natural gas plants in this article.

If you are interested in long-term financing of LNG projects, please contact our team at any time.