International financial engineering services

Skywalk Investment Group offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

The technology and client needs in the financial sector are changing at both the micro and macro levels, as evidenced by the development of new areas such as financial engineering.

We live in a time of total data collection, the skillful use of which can lead to an improved quality of life for all people, as well as bring huge profits to companies that can use it.

The tools of computer science, economics, finance, and engineering are merging on an unprecedented scale.

The importance of financial engineering in the modern world can hardly be overestimated. It is used by investors and major international financial institutions such as banks, insurance companies and engineering giants.

The right choice of a financing model for a new project today can decide the fate of a multi-billion dollar investment.

LBFL is an international company offering advanced financial engineering tools for large projects in Europe and beyond.

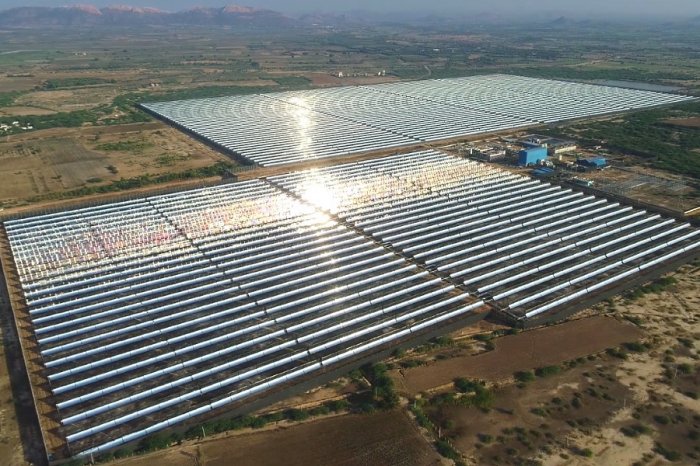

We and our partners have been involved in financing the construction of power plants, waste treatment plants, LNG plants, mines and ore processing plants, gas pipelines and seaports, offering optimal solutions for customers.

Why financial engineering is important for large projects

Financial engineering is the creation, development and implementation of innovative financial instruments and processes, as well as the formulation of innovative solutions to various problems in the field of finance.Financial engineering refers to the operation of complex financial processes and is based on the study and flexible application of numerous financial instruments.

A new stage in the development of financial science began after World War II, when in 1952 the American scientist Harry Markowitz published his article with a detailed basis for calculating risks in the formation of an asset portfolio.

Financial engineering is of great importance in modern theoretical and practical finance.

It is based on the concept of the financial market as a dynamic system, the evolution of which can be described by complex mathematical models.

The subject of financial engineering is the development of financial instruments with the required parameters, as well as mathematical analysis and minimization of the risks of financial activities.

There is no single simple definition of the term "financial engineering", but this area includes the theory of finance and economics, mathematics, programming and engineering.

Financial engineering includes:

• Business value management.

• Fundamental and technical analysis of projects.

• Professional risk management.

• Investment modeling.

• Financial innovation.

Combining statistics, financial analysis, financial management, accounting and other areas of expertise, financial engineering makes quite significant adjustments to the activities of financial institutions such as banks and investment companies.

It is rather difficult to connect all these areas with each other.

This requires statistical, engineering and mathematical knowledge to prepare the data, as well as financial, economic, and sometimes even sociological and psychological knowledge.

Experienced financial engineers are in high demand in the market today.

However, professional financial engineering provides a business with great advantages, for example, in the financial, insurance and energy markets. It is a very effective approach for predicting price changes and the dynamics of supply and demand.

Financial engineering tools were first widely used in the early 90s.

With the development of computer technology and globalization of markets, the importance of this area has grown.

Financial engineering will become indispensable for the implementation of large projects in the coming decades, and the future of the industry may depend on highly developed artificial intelligence.

Simple and widely available analytical tools, such as comparing bank loan offers, are highly beneficial as they enable quick and accurate decisions. Financial engineering is a much more complex tool that is extremely difficult to understand.

Its application has already brought many benefits to major players in global markets, but there is also a lot of criticism of financial engineering. Some financiers argue that there is too much emphasis in this area on huge databases, making it out of touch with reality. It has been suggested that excessive confidence in the results of financial engineering can lead to the collapse of large companies and even become one of the causes of global financial crises.

Despite the criticism, this area will continue to evolve and drive informed financial decisions for businesses in the long term.

Experts identify several factors that contributed to the development of financial engineering and its active use in the implementation of large projects.

These factors can be classified into external and internal. Business cannot control external factors, although these factors significantly affect the performance of companies and the success of their investment projects. Internal factors can be controlled to some extent.

External factors include changes in interest rates, globalization of markets, technological progress, tax policy, and so on. Internal factors of the company include liquidity needs, risk management methods, administrative costs, etc.

The main reasons for the transition to financial engineering:

• Introduction of a complex high technology production.

• Globalization and development of the international capital market.

• Possibility of international diversification of investment portfolios.

• The need to attract the cheapest financing possible.

• Development of computing technologies and new financial instruments.

In today's reality, successful companies build long-term relationships with consumers, suppliers, employees and shareholders.

They are forced to maintain and develop their competencies in order to obtain long-term benefits. They act quickly so that short-term barriers do not interfere with the long-term strategy of increasing the market value of the business.

Today, when shaping and implementing corporate strategies, top managers must have the qualifications of many specialists, from analysts, production experts to stock traders, dealers, risk managers, and the like. Financial engineering teaches a business to use financial instruments correctly to reduce or avoid risk altogether.

Financial engineers apply modern management techniques to financial markets of any nature. Professional bodies such as the International Association for Quantitative Finance (IAQF) are expanding the opportunities for these professionals to exchange experiences and enhance their skills.

Modern financial engineering tools bring success in financially sustainable and market-oriented projects in a variety of areas, including power generation, fuel and energy sector, urban planning, infrastructure and more.

The financing mechanisms for these projects include loans, venture capital, and the issuance of securities on various scales, most often as part of the project finance concept.

Typical applications for financial engineering include the construction of power plants, water treatment plants and waste treatment plants, transport infrastructure, sports facilities, and so on.

Financial engineering: our services

SWIG offers a full range of professional services in financial engineering, including arranging financing for large investment projects.Our team of experienced financial advisors guarantees support to corporate clients at all stages of the implementation of a business idea.

The activity of a financial engineer is multifaceted, and therefore requires an appropriate knowledge base. Leading financial engineers emphasize the fact that they work in a team. The amount of specialized knowledge required to understand the complex interweaving of financial, legal, accounting and tax issues is always beyond the capabilities of one single specialist.

The areas of activity of our finance team include:

• Development of a strategy for entering the securities market.

• Formation, forecasting and evaluation of financial models.

• Consulting on any issues related to the issue of shares and bonds.

• Increasing the value of the company using innovative tools.

• Development of an optimal strategy for working with financial intermediaries.

• IPO technology for the initial placement of the issuer's securities.

• Reorganization of the share capital (merger or acquisition).

• Control over the company's activities in the financial market.

• Optimization of business taxation.

• Financial innovations, etc.

Price and operational risks increase when implementing large projects, therefore, the importance of skillful risk management in lending and investing arises.

Our clients also need services to efficiently and securely manage their cash flows within the global market.

Most of LBFL's innovations have come from solving specific customer problems. Together with our partners, we have participated in dozens of projects in Europe, North America, Latin America, Africa, the Middle East and East Asia, always demonstrating a commitment to financial innovation.

If you are interested in reliable services in the field of financial engineering, please contact our representatives.

We are ready to provide customized solutions for financing your project.