To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

For Europe, the development of programs in the energy and oil and gas sectors is of great importance, along with ensuring high competitiveness and maintaining innovative activity.

The widespread use of project finance in Europe is ensured by the coordination of large financial centers interested in investing in large projects.

The investment climate in the EU is unstable, therefore, borrowers and lenders must be aware of the risks they are taking on.

Highly qualified financial teams are involved in project financing for European companies, and many companies create dedicated departments that make informed investment decisions.

The financial team of Skywalk Investment Group is ready to develop an optimal financing model for your investment project, providing professional support at any stage of the project.

The essence of project finance and its role in the European economy

Project finance is one of the leading methods of attracting long-term debt financing for large projects through financial engineering tools.Project finance in the EU has been around for a long time, facilitating the implementation of capital-intensive investment projects in strategic sectors.

This method is based on borrowing funds against a cash flow generated only by the project itself. The success of a PF depends on a detailed assessment of the project, its operational risks and revenues and their distribution among investors, lenders and other participants on the basis of contracts.

It should be noted that PF does not need to be understood as the concept of "project financing".

Projects can be funded in a variety of ways.

Large-scale projects related to the public sector in developed countries were financed through public borrowing, while private sector projects were financed by large companies that raised corporate loans.

In developing countries, most projects are financed from public funds, and the state, in turn, attracts money in the international banking market or uses export credits. Over time, this approach began to change, which was associated with privatization and a decrease in state control over public infrastructure, energy and other industries. Gradually, a large share of project financing as a result fell to the private sector.

In European countries, these processes took place earlier than in neighboring countries, which led to the rapid development of the concept of project finance in the EU.

Project finance is one of the most difficult ways to implement an investment project, since the PF model includes numerous financial, legal and market mechanisms. There is no such thing as "standard" project finance, since each contract has its own characteristics depending on a specific project, industry or market situation. As leaders in PF, European companies and financial institutions have developed a wide range of financing options suitable for every business. However, there are general principles at the heart of any project finance contract.

General characteristics of project finance:

• The PF is carried out through an independent legal entity (SPV), which implements a specific project and is responsible for its debts.

• Project finance can cover 70-90% of the investment cost of the project, but usually requires a certain initial contribution from the initiator.

• There are no guarantees from investors, since the borrowed funds are provided for the future cash flows of the project and limited assets of the SPV.

• The loan can be secured by SPV assets, cash flows, agreements (contracts), licenses or property rights for the use of natural resources.

• The investment project has a limited life span, which depends on contracts or licenses, or on natural resource reserves in the case of mines or open pits.

• The debt must be paid to the participants by the end of the project term.

Project financing consists of many elements, but in each case, the financing model is built individually, based on the needs of a particular investment project.

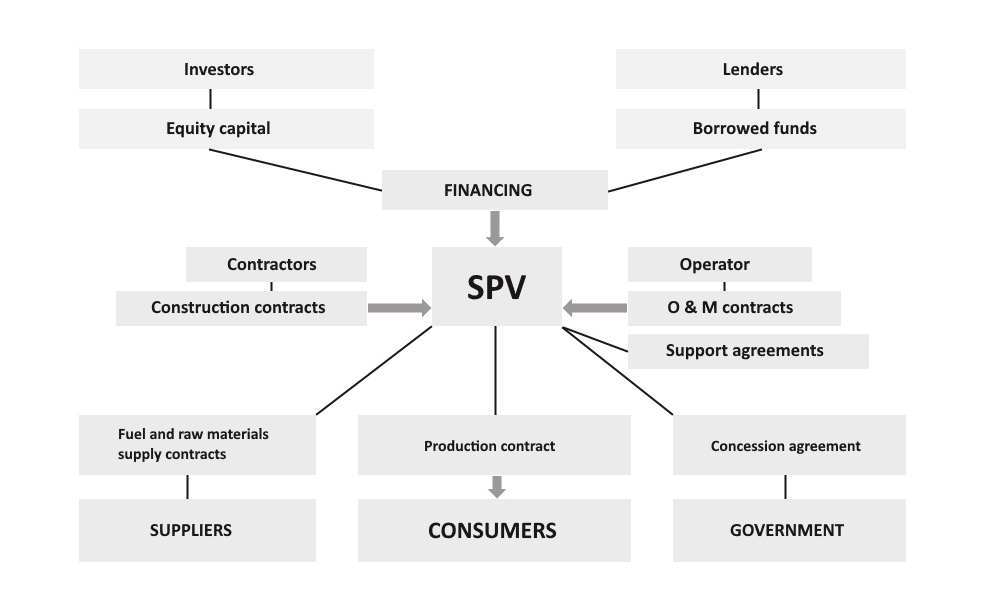

The figure below shows a simplified project finance model.

Project finance has two components.

This is the equity capital, which belongs to the investors of the project, as well as the borrowed capital provided by the lenders. The borrowed funds must be paid by the SPV primarily from the project's cash flows, while the investors' income depends on the success of the project as a whole.

SPV enters into contracts that provide support and financing for the construction of the facility, including through the redistribution of risks to other project participants.

This includes agreements for the production and sale of products, as well as concession agreements with government authorities or other public organizations.

The implementation of this agreement gives the SPV the right to create and profit from the project, providing services either to the public sector (for example, public buildings), or directly to citizens (for example, a toll road). In some cases, the company may require a licensed one (power plants, mobile networks).

Other project contracts may include the following:

• EPC contract for engineering, equipment supply and construction, according to which the project will be developed and implemented for a certain price and by a certain date.

• Contracts for the supply of energy, raw materials and fuels, providing critical supplies according to a long-term pricing formula in pre-agreed volumes.

• A government assistance agreement (usually applied in developing countries) that provides various types of support such as procurement guarantees or tax breaks for a project.

• O&M contract shifting responsibility for the management of the finished plant to qualified contractors.

SWIG Investment group is ready to act as a general contractor, investor and professional financial advisor in the implementation of long-term capital-intensive projects in any country in Europe.

Sources of capital in European project finance

There are three sources of capital in bank project finance.Firstly, these are investments that form the project's equity capital (usually the initiator's share is at least 10%). Secondly, it is subordinated (secondary) debt.

Finally, this is the main debt, that is, those debt obligations that creditors are entitled to collect from the assets of the enterprise in the event of a project closure. The latter group is usually made up of loans from bank syndicates and international organizations, as well as funds from state export agencies.

| Sources of capital in project finance | ||

| Investments | Subordinated debt | Main debt |

| The main banking project finance instruments in the European market | ||

| Attraction of borrowed funds | Corporate finance | Alternative instruments |

|

Targeted loans Subordinated loans Bonds |

Mergers and acquisitions Financing advice Restructuring companies |

Venture investments Real estate operations Share capital |

The project can be implemented as part of a new enterprise or in an existing business.

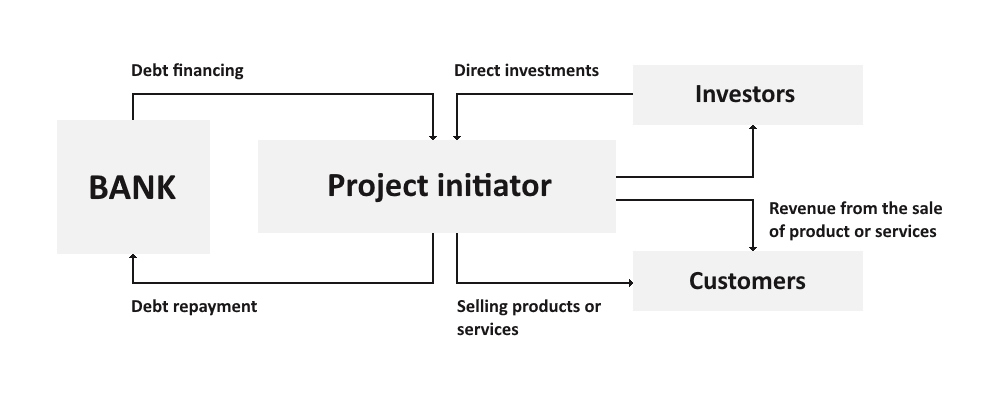

The classical model of project financing with the participation of banks is shown in the figure below.

This model applies to investment projects that are implemented by large companies.

Loans for such a project are provided with a deferred payment, participation in leasing operations is possible, as well as equity participation. The credit risk of such a model is quite high, but it is shared between the project participants (lender, borrower and third parties). The debt is repaid to the creditor after the generation of stable cash flows of the project.

The term of capital use is quite long.

In European investment practice, it usually takes more than 7-8 years.

A mixed project finance model involving banking institutions is shown in the following figure.

The mixed model assumes a standard loan without deferred payment. A project under such a model is often associated with the modernization of equipment or the expansion of production on the basis of an existing enterprise.

The credit risk is moderate and is entirely with the borrower. The main source of payment for the services of a banking institution is the financial flow of the project. The capital is used for a short period of time and rarely exceeds 4-5 years.

Project finance always comes with risk.

The following stages of risk management are listed below:

• The first stage of the project can be called pre-investment. At this stage, information is collected and the future project is analyzed, the estimated risks are calculated for their optimal distribution among the participants. At this stage, it is important to correctly distribute all risks, which determines the success of the project.

• The second stage of risk management is control over the fulfillment of all obligations assumed in the project. At this stage, SPVs, lenders and investors control risks. It is necessary to quickly collect information about the actions of all participants. The complexity of this stage lies in the large number of participants and their heterogeneity.

• The final stage is directly related to the result of the project. At this stage, market risk may appear (eg insufficient demand, disruptions in the supply of fuel or raw materials).

European banks participation in project finance models

Banks play an important role in organizing project finance, and they can also act as consultants.The bank is assigned an important role in the development (analysis and assessment) of various options for the implementation of the project, the organization of its financing, the development of risk distribution schemes and much more.

The Bank carefully analyzes the specific requirements that the proposed project must meet for its successful implementation.

Project finance with the participation of banks has the following features:

• The targeted nature of the investment project financing program.

• The bank allows the company to use significant financial resources to meet specific project goals.

• Flexible lending terms and interest rates suitable for companies with low creditworthiness.

• Banks secure loans from the income that will be received as a result of the implementation of the project.

• The bank guarantees the repayment of the debt both by the future financial flows and by the assets of the borrower.

• PF requires a high-quality approach to project development in order to prevent risks, therefore the bank may require technical data of the project: (calculation of costs, technical documents and the conclusions of experts).

• Not only commercial banks can participate in the implementation of the project, but also investment banks, investment funds, large financial companies, leasing companies, etc.

• Funds can be provided in different ways, for example, creating joint ventures, issuing debt securities.

• The main principle of project risk management is the rational distribution of these risks among the participants.

• Due to the high risk of financing the project, its management is carried out by the investor himself or the lender.

• As a rule, a separate structure (SPV) is created, which has independent management and balance.

• The bank has the right to acquire a certain share in the authorized capital of the enterprise.

• The bank can simultaneously be the organizer and the lender, providing part of the resources for the project.

In general, the system of project finance with the participation of banks is a clearly organized set of financial sources, schemes for raising capital and instruments for financing an investment project.

In Europe, project financing is almost always carried out internationally, with the participation of a number of companies from EU countries and beyond. An example of an international project is the Eurotunnel project, in the implementation of which fifty international lenders took part, and the main lender was a bank syndicate, which included 198 banks.

International financial institutions play a very important role in the development of project finance.

They are working out new models of PF, which are later used by banking structures, as well as working out options for participating in projects in cases where the organizers are various local structures.

All this leads to an increase in the role of the World Bank and other international institutions in organizing joint project finance. For example, in the 1980s, only about a third of loans from this group went to the development of international projects, and now half of bank loans are spent on such projects.

Private investors and lenders understand that by cooperating with a bank, companies receive a number of benefits. These clear benefits include highly skilled project consulting and project management. In addition, the bank assumes the risk of default on the part of the borrower with a number of reservations.

The World Bank not only cooperates with private investors, but also actively participates in projects with regional development banks.

Thus, the involvement of this group allows companies to use advanced solutions for capital intensive projects.

Against this background, investors pay less attention to the reputation of the borrower, and much more attention is paid to the implementation of a specific investment project and the sustainability of the local economy.

The EBRD (European Bank for Reconstruction and Development) finances large projects under a trigger scheme. For each borrowed euro, there is a maximum of resources attracted from other sources. For example, in the Zarafshan-Newmont Gold Project in Uzbekistan, the EBRD's share was one third of all investment funds, and in a number of subsequent investment projects, the bank's share was reduced to 20%.

In Russia, by the mid-2010s, the EBRD signed 529 projects worth 8.2 billion euros, which made it possible to attract an additional 15.2 billion euros from other financial sources (up to 65%), which is a good indicator for the bank.

Recently, developed countries have been trying to use the whole range of sources and methods of financing investment projects, bank loans, bonded loans, and financial leasing. In some cases, project finance is carried out through the use of government funds in the form of guarantees and tax incentives, and sometimes government grants and loans.

The largest lenders are commercial banks, which account for about 80% of loans to finance private sector projects.

More than 20 large banks are leading in the implementation of project finance and managing investment projects on a global scale. Project finance leaders, in particular, have official representations in the USA, Western Europe and Asia.

The total volume of transactions of these banks in 2015 amounted to 83 billion dollars (more than 76 billion euros at the ECB exchange rate), and they cover 60% of the lending market in the field of project finance.

Against the background of the general growth of project finance, the distribution of projects by industry is not uniform. PF has become widespread in the energy sector, due to the historical features of the construction of power plants and the expansion of the power grid. The active participation of banks in these projects is explained by the fact that commercial banks accumulate significant amounts of funds and therefore can act as large lenders.

Recently, more attention has begun to be paid to other sectors.

So in 2015-2018, European banks actively supported the development of capital-intensive projects in social infrastructure, mechanical engineering and renewable energy.

There are several key features that successful European banks involved in financing large projects have in common:

| Features | Short description |

| Limited number of activities | Activities in a limited number of funding areas allows bank to develop the necessary competencies and concentrate resources. |

| Selection of investment projects with maximum payback and economic effects | When deciding on financing a project, banks analyze the transaction and select projects with an acceptable level of risk and high return on funds. Development banks also assess the economic effects of potential projects and select projects that bring the greatest benefit to the state and society. |

| Compensation mechanism for unprofitable projects | Sometimes development banks have to carry out projects with a high degree of risk and incomplete return on investment. These are projects carried out within the framework of various EU programs. For such projects, the state in advance creates compensation mechanisms to maintain the profitability and financial stability of the bank. |

| State support | All successful development banks receive support from the state and the European budget. This can be direct financing on favorable terms, the provision of government guarantees and subsidies for financial products. In some cases, due to the high rating of the founding states, banks are able to attract inexpensive financing in the capital markets. |

| Break-even activity | Development banks do not aim to maximize profits, but they must maintain consistent profit levels. This allows financial institutions to maintain a stable financial position and attract additional resources for economic development. |

International experience in project finance

Project finance is widely used in Western countries, especially in the European Union, UK and USA.This is due to the urgent need to create and maintain a competitive innovative economy against the backdrop of growing competition from developing countries in Asia.

The share of project finance in the modern financial market is also growing. The developing countries of North Africa and the Middle East are becoming one of the leaders today. The largest number of projects in recent years has been registered in several leading sectors such as gas, oil, social infrastructure, and transport. Project finance is increasingly organized by international financial institutions such as the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD).

Currently, companies use three main schemes for project finance.

These include BOT (Build, Operate, Transfer), BOO (Build, Own, Operate), and BOOT (Build, Own, Operate, Transfer).

BOOT can be characterized as follows: the project company, after the project is completed, becomes the owner of the facility and has the right to operate it for the period specified in the contract.

The above mentioned financing schemes have a number of features:

• Obligation to create a project company (SPV).

• The initiator must contribute up to 40% of the total project cost.

• Loan servicing at the investment stage of the project.

• A guarantee from the initiator of the project, observing certain tax and accounting features.

• Qualitative assessment of the borrower's solvency and reliability.

• Accurate analysis of the investment project in terms of feasibility, risk security, efficiency and viability.

• Forecasting the results of the implementation of investment projects.

According to Project Finance International (PFI), this funding solution is helping to solve global problems by accelerating the development of renewable energy in North America and Europe.

Government programs to stimulate the economy have led to an increase in project finance in the European Union, which has a global target of 32% renewable energy in 2030.

There are many examples of successful project finance in the EU.

In Germany, energy projects such as Nordergrunde, Nordsee One, Butendiek Offshore Wind Farm, large IT projects for the Bundeswehr, some projects in the field of public services (educational buildings, hospitals, prisons), as well as construction gas distribution systems.

For Italy, the largest investment project that has been implemented on the basis of the PF over the past decade is the expansion of the Fontanarossa airport in Catania.

In Japan, a significant PF-based facility is the modernization of Tokyo International Airport. Another major Japanese project is a solar power plant with an installed capacity of 230 megawatts worth JPY 90 billion (700 million euros). For Brazil, a major project is the construction of a pipeline to transport ethanol from the central-western region of the country to the consumption centers in the southeast.

The implementation of this project will save significant funds and increase the reliability for the transportation of this product.

In Spain, major projects were the construction of highways, metro and railways.

Project finance is widely used in areas such as waste processing (construction of waste processing plants).

Spain has participated in international projects such as the construction of power plants in Peru, financing the construction and operation of a large wind farm in Maldonado (Uruguay), and a petrochemical plant in Saudi Arabia.

In world practice, for the successful implementation of large projects, its participants unite in consortia for rational distribution and reduction of project risk.

If we consider the European experience of project finance, we can conclude that the most effective solution is participation in large international projects.