To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

The financial system of the United States is complex and diverse, consisting of federal authorities, financial departments and institutions, private banks and corporations that carry out domestic and international financial transactions.

Project finance in the United States can be provided by both large American banks and international financial institutions.

The most famous lenders in this area are the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD).

Project finance in the 1970s-1980s has become a true salvation for debt-ridden corporate America.

Unlike the United States, fragile and corrupt developing countries rarely use pure project finance.

The volume of the project finance market in the United States in 2015 was $ 56.5 billion with 140 transactions concluded, which was about 20% of the number of transactions in North and Central America. The structure of project finance in the United States in 2015 included the electric power industry (41.9%), the oil and gas sector (33%), infrastructure and transportation projects (13%), and mining and processing of minerals (1%).

Skywalk Investment Group, an investment consulting company with European roots, offers international project finance for large investment projects in the USA, Canada, Latin America and other regions of the world.

Contact our finance team for details.

Project finance achievements in the USA: the largest investment projects

For the past 30 years, project companies have been used as a vehicle for the securitization of real estate-based financial products.This was facilitated by favorable lending conditions and liberal financial regulation.

These companies contributed significantly to the growth of the global economy, but subsequently led to the US mortgage bubble. The 2007 crisis highlighted the disadvantages of using such models, as excessive flexibility allowed companies to conduct unreliable transactions with serious consequences. Examples include corporations such as Bear Stearns and Lehman Brothers, which have been discontinued.

Project companies provide investors with access to otherwise inaccessible investment opportunities in securitization, fundraising, risk sharing, etc.

Without creating an independent company, operations of this kind impose high risks on the business.

On the other hand, SPV also carries certain risks for the sponsor (low transparency, reputational risk, liquidity and capital risks).

The lessons learned have led to increased regulatory oversight of these companies. Stronger principles of control and transparency were introduced as part of the revision of the laws governing project companies. A key example of this is the adoption of Basel III international standards that require banks to maintain adequate levels of capital and liquidity. As a result, the cost of loans for project companies has increased.

At the moment, there is a discussion about the advisability of closer integration of SPV with sponsors or their complete separation.

Either way, project companies should clearly assess the impact of internal (structure) and external factors (competition, regulation, etc.) on their activities. Their future depends on their ability to communicate clearly to investors and to balance their risk portfolio.

Examples of the largest projects implemented on the basis of PF in the USA

The largest PPP project in the United States, implemented on the basis of project finance, is the construction of Chicago South Suburban Airport worth $ 14 billion.This is the third airport in the city, which serves passenger, transport and business flights. The project is owned by the Illinois Department of Transportation.

Another project is the construction of a complex for the production of liquid natural gas in Texas (SPV Cheniere Corpus Christi Holdings, LLC). The development of the project was carried out by Cheniere Energy, which invested $ 4 billion. The transaction involved 31 banks, which provided $ 8.4 billion for the construction of the first two phases of the project in May 2015. Subsequently, another $ 3 billion was allocated for the construction of the third train.

Also worth noting is the construction of a complex for the export of liquid natural gas in Louisiana (SPV Lake Charles LNG Export Company, LLC).

The project is carried out by Energy Transfer Partners, which invested $ 2.8 billion.

The project started in 2011, and the amount of debt financing reached $ 8.1 billion.

The construction of two 1117 megawatt nuclear reactors in South Carolina was estimated at $ 9.8 billion, including borrowed funds (V.C. Summer Nuclear Station). The project is sponsored by South Carolina Electric & Gas and Santee Cooper.

The project was first announced in 2009, but the license for the construction of two new NPP units with AP-1000 reactors was only issued in 2012. As a result of technical and financial difficulties, the project was stopped.

The essence of project finance: principles, sources of funds, risks and models

Regardless of the purpose, with traditional forms of debt financing and equity financing, it is usually assumed that the borrower guarantees the payment of the debt with all available assets.The source of funds for debt repayment in this case is the cash flow generated by the company's assets, including those projects for the implementation of which additional financial resources were attracted.

Project finance in the United States is distinguished by the targeted use of the allocated funds for the implementation of a specific investment project.

It is used mainly to finance investment projects related to the real sector of the economy. In particular, PF is the most important way of financing the so-called innovative projects aimed at developing new types of products and new technologies.

The source of funds for investors is the flow of money generated directly by the project, and in this case the assets that were acquired for its implementation act as collateral.

Project finance has a number of specific advantages that distinguish it from other types of financing. American investors prefer to use PF instruments in established industries and projects, the results of which can be more accurately predicted compared to innovative facilities.

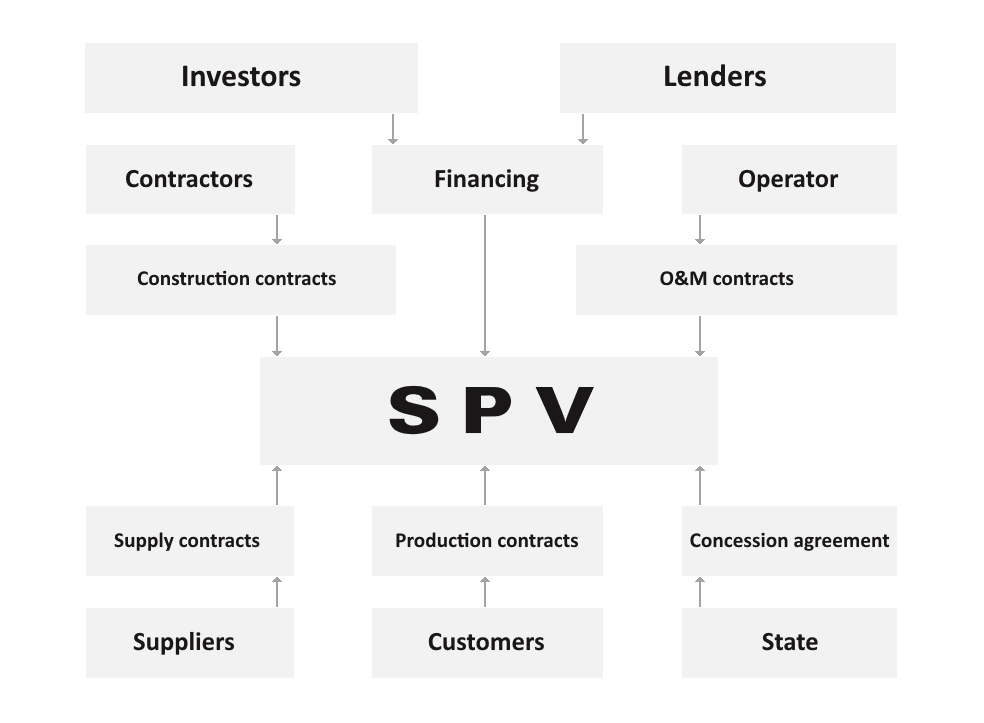

As a rule, the implementation of the project requires the establishment of a special purpose vehicle (SPV), the founders of which are the initiators of the project.

Sponsors finance 10-40% of the project cost through the authorized capital of the newly created company. Further development of the project and attraction of borrowed funds is carried out by an independent project company.

This approach has several advantages.

First, the emergence of a new company makes it possible to avoid the negative impact on the project of circumstances that are associated with the history of the initiator.

Secondly, the project becomes more "transparent". Planning and managing cash flows is greatly simplified due to the lack of non-project related activities.

Thirdly, this model allows initiators to significantly expand the circle of project participants.

The scheme of interaction of PF participants is shown in the figure.

The period of participation of each investor in the project is determined by his role in the overall investment structure.

Depending on the goals of investors, the PF can act both as a specialized financial instrument used in underdeveloped industries, and as the risk diversification tools for a large company in the form of off-balance sheet financing of capital-intensive projects. The list of possible participants in the scheme and their role in the project are shown in the table below.

Table: Project finance participants and their roles.

| Participants | Role in the investment project |

| Initiators (sponsors) | Companies and individuals create a project, solve current issues and receive official permits. |

| Suppliers and contractors | Companies that have contractual obligations for the supply of products and services related to the project. |

| Buyers (customers) | Conclusion of long-term contracts with a group of companies for the purchase of a certain guaranteed amount of products, because in most projects, the product does not go to the open market (for example, an LNG supply contract). |

| Government bodies | Provision of guarantees and necessary permits, as well as participation as a sponsor or shareholder of the project. |

| Project managers | A professional management team that oversees the implementation of the project. |

| Investors (lenders and shareholders) | Legal entities and individuals providing equity or debt financing for a certain period of time and on pre-agreed terms |

| Consultants and advisors | Specialized companies and individuals, competent in various aspects of the project. |

The mechanism of project finance in the United States involves the formation of a system of guarantees that protected both the interests of the attracted investors and the founders of the SPV.

The general goal of creating such a system is to distribute all the risks associated with the implementation of the project between the parties in such a way that each of them bears only those of them that it is able to manage. A multilevel guarantee system allows a significant increase in the share of loans with a slight increase in financial risk.

The reasons for using the PF can be as follows:

• The scale of the project and the required amount of funding.

• Impossibility of project implementation by one initiator company.

• High risks of project implementation at a high project cost.

• Intersection of interests of several parties.

• Lack of resources.

In general, the international project finance mechanism is a flexible option for raising funds than traditional financial models.

Our company is ready to provide long-term financing of large investment projects in the USA and other countries with a minimum initiator's contribution of up to 10%.

The benefits of project finance include the following:

• Risks are shared among all project participants.

• The assets and liabilities of the project are on the balance sheet of the SPV, not its shareholders.

• The own contribution of SPV shareholders, as a rule, does not exceed 40% of the project cost.

Project financing is characterized by a wide range of lenders, which makes it possible to organize consortia.

The interests of creditors are, as a rule, represented by the largest credit institutions (agent banks). Despite the high development of project finance in the United States, this model is associated with certain risks at each phase of the project. The typical risks of PF are listed in the table below.

Table:International project finance risks.

| Investment (construction) phase | Operation and maintenance phase |

| The risk of untimely completion of construction and, as a consequence, the risk of putting the facility into operation (completion) with a delay. | Refinancing risk (the ability to increase the term of use of borrowed funds by paying off old debt and attracting a new one, reducing the cost of borrowing). |

| Risk of cost overrun or underfunding of the project by shareholders. | Currency risks associated with the mismatch of exchange rates, on which the proceeds from the project and debt obligations depend. |

| Risk of failure to reach the planned design capacity. | Risks of changes in legislation, as well as changes in regulatory mechanisms during the period of project implementation |

Project finance risk is defined as the monetary expression of the potential deviation of the actual result from the expected results (the occurrence of a risk event) due to the uncertainty of external and internal factors associated with lending and other banking processes.

In order to reduce credit risk, project participants need to conduct thorough research, while ensuring professional project management at all stages.

Features of international project finance in the USA: instruments, participants, regulation

The main source of business financing in the United States is the stock market.International project finance as a method of financing large projects using borrowed funds is considered a highly effective and versatile tool widely used in various sectors of the American economy. Project finance in the United States means an advanced organization of financing, in which the only source of debt repayment is the cash flows from the project.

In this case, interest and principal payments are made using the future cash flows of the project.

The sponsor shares the risks, as well as the income from the project, with attracted investors (shareholders) and lenders of different levels. When deciding on investments, financial institutions look primarily at the profitability of the project, not at the assets of the initiator, suitable for sale in the event of a project failure.

The main difference between project finance and the traditional way of attracting debt capital is the source of funds for repaying debt and project losses.

In the traditional version, this source is the initiator's assets.

With international project finance, borrowed funds are issued against the cash flows generated by this project.

The following parties can act as participants in project finance:

• Project sponsors.

• Borrowing company.

• Financial consultants.

• Technical consultants.

• Legal consultants.

• State and commercial banks.

• Various investor groups.

• Regulatory agencies.

The most popular form of project finance in the United States is EPC (engineering, procurement and construction).

The EPC contract usually includes the obligation of the general contractor for the construction and delivery of the facility at a certain predetermined fixed price, by a certain date, in accordance with the specified technical requirements.

The EPC contract is quite complex from a legal point of view, therefore, the project company and the contractor must have sufficient experience and knowledge in the implementation of similar projects in order to avoid mistakes and minimize the risks of the contract.

The terms “EPC contract” and “turnkey contract” are used interchangeably, however EPC includes design, procurement of required materials and construction of a facility.

The main components of a typical EPC contract are:

• Description of the project.

• An estimate that includes all types of expenses.

• Amount and schedule of payments.

• The deadline for the commissioning of the facility.

• Contract performance guarantees, including compensation in case of breach.

• Guarantees that the facility will reach its design capacity.

Project finance in the United States is subject to dual regulation by both federal and regional governments.

Project agreements can be subject to the laws of almost any state, but the rule here is "lex situs", which means "the law of the location of the property" (the laws of the state where the assets are located).

There are numerous federal agencies involved in the regulation of a specific sector in the regulatory process.

These include:

• Federal Energy Regulatory Commission.

• The United States Atomic Energy Commission.

• The United States Environmental Protection Agency.

• The U.S. Securities and Exchange Commission.

Project agreements are usually governed by New York State law.

The conclusion of financial agreements is often carried out in New York, as its legislation is the most advanced.

The latter contributes to the transparency of agreements and the reduction of costs in the resolution of disputes.

However, a number of documents relating to various types of permits may still fall under the jurisdiction of the state where the project assets are located.