To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Solar energy is used for water heating, space heating and air conditioning.

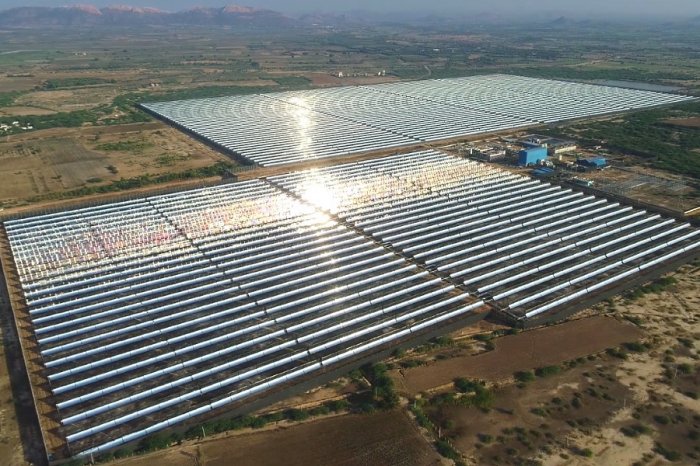

Deserts have a special potential, which in 6 hours receive more energy than all of humanity spends in one year.

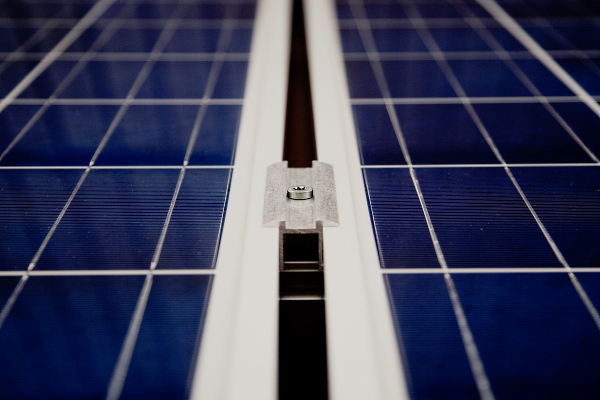

The rapid development of photovoltaic (PV) technologies and the increase in financing of solar power plants have made this sector a competitive alternative to fossil fuels.

The development of photovoltaics around the world will only accelerate in the coming years. This applies both to mega-projects with multibillion investments and to small solar systems installed on private homes, industrial facilities, commercial facilities, and so on.

For example, in the capital of Germany (one of the European leaders in increasing the installed capacity of renewable energy sources), from the beginning of 2023, the order to install photovoltaic systems on the roofs of all new buildings or buildings that have undergone roof repairs will come into effect.

Obviously, this trend towards an increase in the share of RES in the global energy mix will be accompanied by the rapid growth of the industry of mining and processing of silicon, production of photovoltaic modules and engineering.

This will cause growth of long-term bank financing, as well as commercial and industrial loans in the field of solar energy and related sectors.

A huge pile of environmental, economic and political problems, which accumulated during the last decades against the background of naive confidence and full dependence of Western economies on fossil fuels, suddenly fell on the heads of consumers in the form of astronomical prices for natural gas and electricity. According to the International Energy Agency, global investment in renewable energy will grow by a record 8% in 2022, reaching 2.4 trillion US dollars.

But the income of the oil and gas sector in 2022 is expected at the level of 4 trillion US dollars, which is almost double the figures of previous years.

Financing solar energy projects and other renewable sources needs more attention, and as soon as possible.

The cost of solar power plants is decreasing

If you compare the costs of generating electricity at new power plants with different technologies, solar energy is relatively cheap.In particular, large solar photovoltaic plants produce the cheapest electricity due to economies of scale. The investment attractiveness of photovoltaic technologies continues to grow amid skyrocketing gas prices hitting European consumers in 2022.

The cost of generating electricity from a solar PV plant describes the ratio of total costs to actual electricity production (MWh), both of which are related to the useful life of the solar plant.

Typical costs of photovoltaic installations include the following:

• Initial investments for construction and installation of systems.

• Financing costs: securities placement costs, bank fees, loan interest and others.

• Operating costs during the life of the project (insurance, maintenance, repairs).

• Expenses for transportation of equipment and others.

It is worth noting that the decrease in the solar energy price in recent years is primarily related to the decrease in the cost of the main components of photovoltaic systems.

In particular, prices for photovoltaic modules fell by 90% between 2010 and 2020. Overall, the cost of building solar power plants has fallen by 75-80% since 2005 due to technological advances, economies of scale and the adoption of new technologies. This requires huge investments in the very early stages of the project.

As of 2021, the cost of building solar PV plants ranges from $650,000 to over $1 million per 1 MW of installed capacity. It depends on the host country, the technologies used and the project scale.

The annual operating costs of a solar power plant are considered relatively low, accounting for approximately 1-2% of the total investment costs.

This is the biggest advantage of solar energy over conventional thermal power plants, which burn fossil fuels and thus require enormous operating costs throughout the life of the project.

Relatively low operating costs make investment in solar power plants more predictable compared to fossil fuel-dependent projects.

Bank financing of solar energy projects

A significant number of countries direct their energy strategies to the development of renewable energy, as there is an urgent need to ensure energy security and smooth out the negative impact of such indicators as the increase in energy prices, the depletion of global hydrocarbon reserves, geopolitical risks and environmental problems.Thanks to this, there is a rapid development of technologies in the field of renewable energy, primarily in photovoltaics.

Considering the need to accumulate significant financial resources for the introduction of solar PV technologies for electricity production, governments, international financial institutions and large commercial banks are making significant efforts to develop long-term financing programs for solar power plants, in particular, to simplify bank investment lending.

In 2021, China ($266 billion), the United States ($114 billion), Germany ($47 billion) and the United Kingdom ($31 billion) accounted for the largest investments in the solar energy sector.

It is difficult to determine the share of investment loans of commercial banks in the RES sector, because they mainly include long-term loans, but in practice credit lines and other short- and medium-term instruments are often used for investment purposes.

However, general trends allow experts to draw conclusions about the growing role and impact of bank financing on the development of solar photovoltaic projects.

European studies show that in recent years more than 80% of banks have provided loans in one form or another to finance projects in the field of renewable energy sources, in particular for the construction of solar power plants.

The role of banks in the green energy support system is not limited to lending to investment projects. Banks should become more involved in cooperation with government institutions, other financial institutions, municipalities, enterprises and other interested parties of energy transformation in the local sphere than before.

The analysis of financial offers of banks for financing investments related to solar energy sector allows us to draw the following conclusions:

• Financial products aimed at investing in green energy are offered by only a few large commercial banks and cooperative banks on soft lines or as commercial products.

• Many financial institutions, including most local banks, do not offer special loans for the construction of solar power plants, and if they do finance such projects, they do so with traditional investment loans (usually offered for other areas of business).

• Few commercial banks are associated with a more favorable offer for customers, such as reduced interest rates or a longer grace period compared to "classic" loans.

Unfortunately, the conclusion is that a large percentage of commercial banks do not pay enough attention to the investment market of renewable energy sources and do not actively work on the issue of improving long-term financing of this energy segment.

This approach may be the result of underestimation of the growth dynamics and development potential of this market, as well as relatively high investment risk from the point of view of banks.

The risk factor remains important for banks due to the fact that the RES investment industry is still young and is still subject to serious regulatory influences, which are not always favorable for investors and lenders. Moreover, the rapid technological progress in photovoltaics means that investments that are profitable today may become economically inefficient in the face of a new generation of technology and will require the "disposal" of previously used equipment.

European bankers pay attention to the following risks of bank financing of the solar energy sector:

• Legal uncertainty arising from frequent changes in regulations and standards.

• The variability of the state approach to solar energy in many countries, as evidenced by the instability of legislation and frequent changes in the scope and rules of support for this area.

• Unpredictable prices and the difficulty of estimating the payback period of solar projects.

• Difficulties in investors receiving subsidies from external sources.

Also, financial institutions pay attention to underdeveloped energy storage technologies and insufficiently thought-out regulation of this issue.

This leads to uncertainty or inability to sell excess energy produced in solar power plants. Meanwhile, this energy could significantly improve the financial performance of solar energy projects, thereby positively influencing the terms of loan agreements and reducing the overall level of project risks.

It is interesting that the position of local authorities in many EU countries and beyond is still not optimal for the development of solar photovoltaic projects.

Most municipalities, according to surveys conducted in recent years, cannot offer new types of financial interaction to support this sector.

Positively assessing the current relationship with banks, local officials in most cases believe that existing traditional instruments such as bank loans or bonds, if properly "tailored" to the needs of the sector, will be sufficient to meet the financing needs of solar energy.

Obviously, companies initiating the construction of new solar power plants or the modernization of existing facilities will have to face certain difficulties in finding and attracting long-term financing, especially when it comes to large projects with multi-million investments.

Skywalk Investment Group is ready to finance your energy projects at any stage of development.

Our investment services in solar energy sector

The construction of solar power plants is recognized as one of the most climate-friendly and stable investments.More and more manufacturers and suppliers are promising impressive prospects for long-term returns on solar energy investments. Against the background of the gradual abandonment of fossil fuels, the financing of renewable energy sources looks more and more attractive.

The main reasons for actively investing in photovoltaic projects include the following:

• High prices for natural gas, coal and other fossil fuels.

• Extensive state support for photovoltaics in the form of subsidies, tax benefits, etc.

• Pro-environmental business policy aimed at reducing carbon dioxide emissions.

• Ensuring energy independence and business security independent of fossil fuel supplies.

In accordance with the current trend of increasing electricity production from renewable energy sources, Skywalk Investment Group offers long-term investment loans for the construction of large photovoltaic solar plants.

By offering comprehensive financial and consulting support, our company aims to further stimulate the interest of large business in the production of renewable energy.

Solar energy has many environmental and economic benefits.

Preferential tariffs, long-term power purchase agreements, priority connection to network and receiving investment assistance ensure the financial capacity of solar power plant construction projects.

Project financing from SWIG also brings additional benefits for investors, such as a long repayment period, a high volume of financing from 50 million euros, minimal financial participation of project initiators, flexible collateral and an optimized repayment plan that matches the future cash flows.

In addition, we and our international partners are ready to help customers with engineering, development of technical and financial documentation, construction of the facility, purchase and installation of photovoltaic equipment, operation and maintenance.

Contact us to learn more.